As the number of customers who make cashless payments such as credit cards has increased in recent years, I think that merchants operating EC sites and physical in-store are considering introducing various payment methods. Previously, in the column "Examination contents and preparations when introducing Credit Card Payment", I introduced the examination contents focusing on Credit Card Payment, but this time I introduced the checkpoints regarding the examination when using a PSP. I would like to introduce you.

Contents

What is PSP?

クレジットカード決済やコンビニ決済、キャリア決済など、決済手段を導入する際には、それぞれのサービスを提供している機関と契約する必要があります。

しかし、導入する決済手段が増えれば増えるほど、導入や管理の手間とコストが増し、EC事業者さまの大きな負担になりえます。

そうした手間をなくし、複数の決済手段の導入や管理を一本化するのが決済代行の役割です。EC事業者さまは複数の決済手段の契約から実際の運用に至るまで、基本的には決済代行会社とのやりとりのみで完結させることができます。複数の決済手段を導入ご検討のEC事業者さまに、おすすめです。

決済代行会社の選び方は「決済代行とは?決済代行サービスの仕組みとメリットを徹底解説」の記事をご参照ください。

▼決済代行会社について詳しく知りたい方はこちら

決済代行会社とは?サービスの仕組みとメリットを徹底解説

I will explain the mechanism of the PSP and the merits of using it for EC merchants.

Flow until examination when using PSP

By using a PSP, you can greatly reduce the time and effort required to introduce multiple payment methods and manage them. However, there is a review when using it, and not everyone can use it immediately after applying. From here, I will explain the flow up to the examination performed by the PSP.

First, the EC merchants is required to fill out and submit the application form prepared by the PSP. After that, the PSP asks the settlement institution that provides the payment methods desired by the EC merchants examination.

The examination content and examination period differ depending on the payment institution, and some payment institutions take more than a month to complete the examination after applying, so if you are in a hurry to introduce a payment methods, apply early. We recommend that you do. In addition, please note that the PSP cannot inform the merchants the examination criteria and the reason for the examination result.

Points to be checked in the examination

Now, I would like to introduce some typical points to be checked in the examination.

Presence or absence of EC site

First, check if there is an EC site where the payment methods is introduced. Before the EC site is released, the payment institution cannot confirm the service content, so the examination cannot be performed. However, even if the site is not open to the public before the start of the business, depending on the payment institution, it is possible to carry out the examination by submitting materials that show the contents of the service site, so please contact the PSP before the examination. Please consult.

Notation of products and services handled

Not only the existence of the EC site, but also the details of the products and services we handle will be checked. The products and business formats handled are important factors in determining the content of the examination and the subsequent settlement fee, so please describe them in an easy-to-understand manner. In addition, please refer to the following for industries and products that are likely to be judged NG.

Industries / products that are likely to be rejected

| Industry |

|

|---|---|

| merchandise |

|

With or without cart function

The important thing in putting a payment methods on an EC site is the preparation of the payment function. Even in the examination, it is subject to confirmation whether the lead wire to complete the settlement is prepared, so if the actual screen is not completed, confirm in advance with the PSP whether the examination is possible with the screen transition diagram etc. please.

Notation based on the Specified Commercial Transactions Law

Regardless of the products or services we handle, if you want to introduce any kind of online payment, you must state the "notation based on the Specified Commercial Transactions Law". Please prepare the URL of the listed page or screen capture.

▼特定商取引法に基づく表記について詳しく知りたい方はこちら

特定商取引法に基づく表記とは?必要な項目や書き方、罰則などを解説

特定商取引法の概要のほか、特定商取引法に基づく表記の項目や書き方、違反した場合の罰則などについてご説明します。

Business performance

The management performance of the business itself is also an easy point to check in the examination. Especially in the case of EC sites, customers and EC merchants do not face each other directly, and troubles are more likely to occur. The examination is also rigorous, and even if you apply for a business or EC site that you just started, it may be difficult to pass the examination. In that case, it is also important to improve the reliability of the business, such as by first accumulating results in in-store.

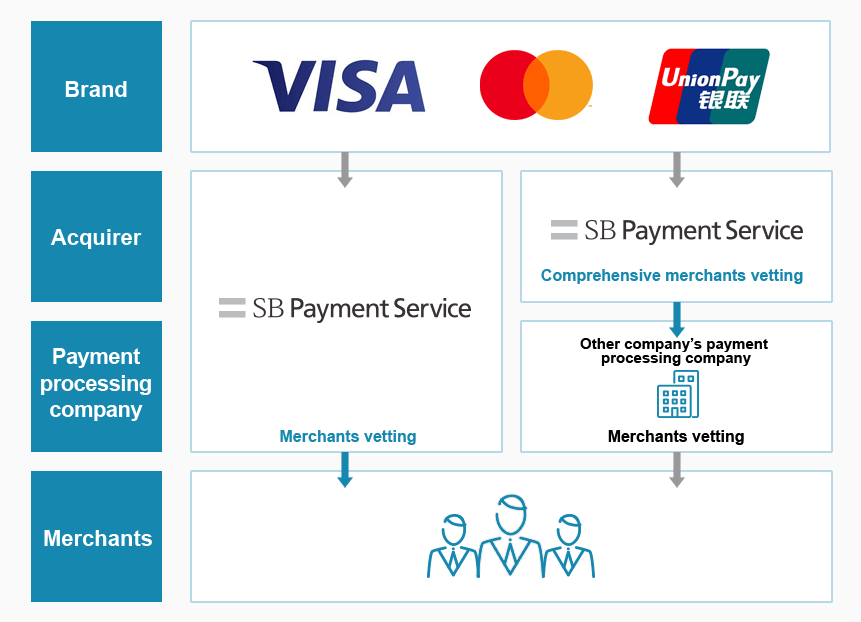

Why SB Payment Service is chosen

We acquired the international brand licenses of Visa and MasterCard in 2011 and UnionPay (UnionPay) in 2015, and as a card company called "merchants", we vetting of merchants and other PSP. We are doing.

We can flexibly support the development of new businesses, including payments, as we can provide a one-stop service from screening to the provision of payment services.

If you are an e-commerce merchants considering the introduction of payment, please contact us.

▼SBペイメントサービスのオンライン決済サービスの導入の流れについて詳しく知りたい方はこちら

オンライン決済サービス導入までの流れ・手順

お申し込みをいただいてから決済サービスのご利用開始までの流れをご確認いただけます。