クレジットカード決済の導入には、クレジットカード会社などによるビジネスや業種といった内容に関する加盟店審査が必要です。一般的には、導入カードブランドに応じた書類や申請が必要となり手間も期間もかかりますが、決済代行会社を利用すればそれらの負担を抑えることが可能です。

当コラムでは、ECサイトの運営に欠かせないクレジットカード決済について、審査の内容や期間、落ちる原因のほか、審査前に必要な準備などを解説いたします。

目次

クレジットカード決済の加盟店審査とは

クレジットカード決済の加盟店審査とは、事業者さまが店舗やECサイトにクレジットカード決済を導入する際に、クレジットカード会社やアクワイアラなどが事業者さまの信用度を調査し審査することです。アクワイアラとは、国際クレジットカードブランドであるVisaやMastercardなどからライセンスを取得し、加盟店の開拓や審査、管理をする機関です。

クレジットカード決済では、クレジットカード会社が一時的に利用者さまの商品代金を立て替えています。通常は、利用者さまの口座から商品代金を引き落としますが、何らかの理由で事業者さまと利用者さまのあいだでトラブルが起こる場合があります。その場合は取り引きが中止になり、クレジットカード会社が立て替えた商品代金を、事業者さまから回収しなければなりません。商品代金が回収できない場合は、クレジットカード会社の損失となるのです。

このような事態を避けるため、クレジットカード会社は加盟を希望する事業者さまの営業実態や支払い能力などを審査しています。

※アクワイアラについては、以下の記事で詳しく説明しております。

アクワイアラとは?その仕組みと役割を解説 | SBペイメントサービス

クレジットカードの加盟店審査で確認する項目

ECサイトの場合、クレジットカードの加盟店審査では以下のような項目について審査を行います。

ECサイトの加盟店審査の主な内容

| ECサイト | カート機能や特定商取引法にもとづく表記などを確認します。 ECサイトが完成していない場合は、詳細が確認できる資料を提出して審査を受けることもできます。 |

|---|---|

| 提供する商品・サービス | 業種や商品によっては審査に落ちる場合があります。 |

| 経営実績 | ECサイトの経営実績がない場合は、実店舗のもので審査を行う場合もあります。 |

クレジットカードの加盟店審査に必要な期間

審査には一般的に、2週間程の期間が必要です。

ただし必要書類やサイト内容の不備があると審査が長引く場合がございます。事業者さまは導入予定日から逆算し、余裕を持って審査に望むことをおすすめします。

クレジットカードの加盟店審査に落ちる原因

クレジットカード決済の導入前に必要な加盟店審査の基準はブランドによって独自に設定されており、その詳細は明らかにされていません。そのため、あくまで推測ではありますが、加盟店審査に落ちる原因として、以下のようなものが考えられます。

審査に落ちる可能性のあるビジネスを行っている

事業者さまが行っているビジネスによっては、審査が厳しく落ちる可能性があります。審査に落ちる可能性のある業種や職種には、以下のようなものがあります。

審査に落ちる可能性のある業種・商品

| 業種 |

|

|---|---|

| 商品 |

|

特定継続的役務を提供している

特定継続的役務とは、特定商取引法によって指定された、「エステ」「美容医療」「語学教室」「家庭教師」「学習塾」「結婚相手紹介サービス」「パソコン教室」の7つのサービスです。特定継続的役務の共通点は、お客さまの目的を実現させるために行うサービスである点と、お客さまの目的の実現を確約できない点です。

これらのサービスは、お客さまによって効果の感じ方に違いがあったり、高額な支払いが必要になったりするため、トラブルになる可能性がほかの事業より高いという特徴があります。そのため、加盟店審査が厳しく落ちる可能性があります。

公序良俗に反する可能性がある

民法第90条で、公序良俗に反する事項を目的とする法律行為は無効とされているため、公序良俗に反するビジネスは、クレジットカード加盟店審査にも落ちる可能性があります。公序良俗に反するビジネスには、暴利行為(高利貸し)、倫理に反する行為(妾契約)、正義に反する行為(悪事をしないことを条件として金を与える行為)、人権を侵害する行為(男女を差別する雇用契約)などが該当します。

個人事業主さま・小規模事業者さまで実績がない

小規模事業者さまはもちろん、個人事業主さまも法人用のクレジットカードを持つことが可能です。ただし、個人事業主さまや小規模事業者さまで実績がない場合も、審査に落ちる可能性があります。ビジネスの実績が乏しい場合は、事業主さま本人の信用情報が重視されます。

信用情報に問題がある

会社の信用情報に問題がある場合も、加盟店審査に落ちる可能性があります。これまでに、ローンの返済やクレジットカードの支払いが遅れたり、自己破産や任意整理などの債務整理を行ったりした場合は注意が必要です。

クレジットカードの加盟店審査前に準備しておくべきこと

ここでは、現在までにわかっている情報から、加盟店審査で事前に準備しておくべきことについて解説いたします。

必要書類の準備

クレジットカードブランドや取扱商品などによって必要書類は異なりますが、おもに以下の書類がクレジットカード会社より求められることが多いです。

• 印鑑証明書

• 資格書類

• 許可証(許認可が必要な商品を取り扱う場合)

• 登記簿謄本のコピー

• 振込先口座情報

ECサイトへのカート機能の準備

ECサイトが閲覧でき、販売商品が掲載されており、ショッピングカートに商品を入れられる状態にする必要があります。

「特定商取引法に基づく表記」を掲載

ECサイト内に「特定商取引法に基づく表記」というページを設けて、以下の内容を掲載しなければなりません。

• EC事業者名

• 所在地

• 連絡先(電話番号、メールアドレスなど)

• 商品の販売価格

• 商品代金以外にかかる代金(決済方法、決定手数料、送料など)

• 代金の支払時期(前払い、代金引換、後払いなど)

• 代金の決済方法

• 商品等の引き渡し時期

• 発送方法

• 返品の可否と条件

• 申込みの有効期限があるときには、その期限

• 商品に隠れた瑕疵がある場合に、販売業者の責任についての定めがあるときはその内容

• ソフトウェアに関する取引である場合には、そのソフトウェアの動作環境

• 商品の売買契約を2回以上継続して締結する必要があるときは、その旨及び販売条件

• 商品の販売数量の制限等、特別な販売条件(役務提供条件)があるときには、その内容

• 請求によりカタログ等を別途送付する場合、それが有料であるときには、その金額

• 電子メールによる商業広告を送る場合には、事業者の電子メールアドレス

必要な許認可を取得し、掲示する

ビジネスによって必要な許認可があれば取得し、ECサイトにわかりやすく掲示しておきます。代表的な例は以下のとおりです。

許認可が必要なビジネスの例

| ビジネスの種類 | 必要な対応 |

|---|---|

| 自社で製造・加工した食品の販売 | 食品の種類に応じた営業許可を取得する。 |

| ECサイトでの酒類の販売 | 税務署に申請して通信販売酒類小売業免許を取得する。 |

| 中古品の販売 | 管轄の警察署に申請して古物商許可を取得する。 |

| 化粧品の製造 | 都道府県の薬務課に申請して化粧品製造販売業許可を取得する。 |

クレジットカード決済を導入すると決めたら

クレジットカード決済を導入するには、2つの方法があります。クレジットカード会社との直接契約か、決済代行会社との契約です。それぞれの特徴は以下のとおりです。方法によって申込から契約完了までに行うことが異なります。

ここでは、EC事業さまにとって、決済代行会社を利用するメリットについてご説明いたします。

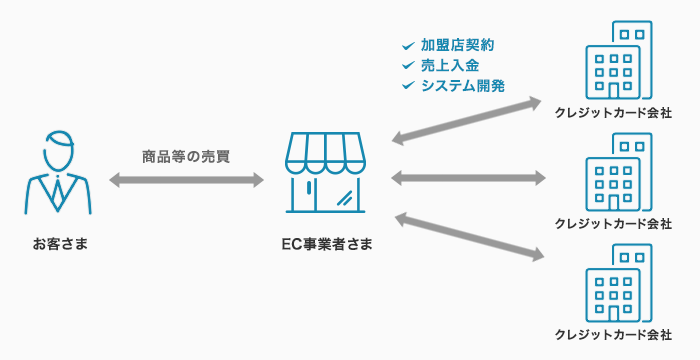

<直接契約の場合> カードブランドごとに審査が必要

<決済代行会社を利用した場合> 一括で審査が可能

決済代行会社を利用するメリット

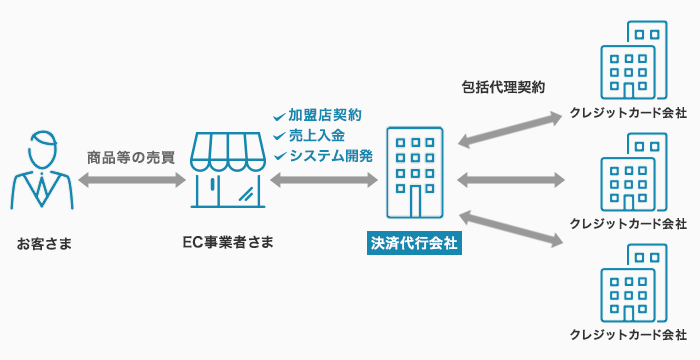

決済代行会社は、EC事業者さまに代わってクレジットカード会社との契約や売上入金管理を行う役割を果たします。上図で示しますようにクレジットカード会社と直接契約する場合は、個別の契約が必要です。そのため、審査に必要な書類の準備やコミュニケーションにかかる時間がクレジットカード会社ごとにかかり、大変手間がかかります。

しかし、決済代行会社をご利用いただくことで、複数のクレジットカードブランドを一度にまとめて契約し、事業者さまの負担を大きく軽減することが可能です。また、その他にも決済代行会社を利用するメリットがあります。詳しくは「決済代行とは?決済代行サービスの仕組みとメリットを徹底解説」の記事をご参照ください。

決済代行会社の選び方

決済代行会社は、それぞれ提供するサービスや特徴が異なりますので、EC事業者さまに適した会社を比較・検討した上でご契約ください。

決済代行会社を選ばれる際に確認しておくべきポイントとしては、以下のようなものがあります。

<決済代行会社を選ぶ際に確認しておくべき主なポイント>

• 決済代行サービスの利用料金

• 取り扱い決済手段の種類

• セキュリティ体制

• システムの安全性と柔軟性

詳しくは「クレジットカード決済代行サービス導入方法と比較ポイントを解説」の記事をご参照ください。

SBペイメントサービスが選ばれる理由

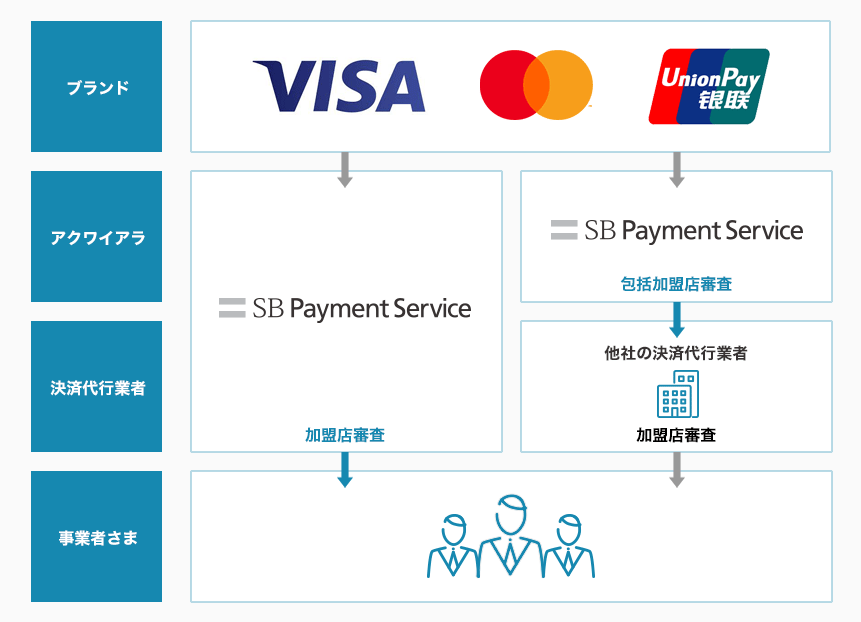

当社は2011年にVisa、MasterCard、2015年にUnionPay(銀聯)の国際ブランドライセンスを取得し「アクワイアラ」という加盟店契約会社の立場として、事業者さまや他の決済代行事業者さまの包括加盟店審査を行っております。

審査から決済サービスのご提供までをワンストップで行えますので、決済を含めた新規ビジネスの展開も柔軟にご支援させていただきます。

上述のとおり、当社のサービスでは多くのメリットを事業者さまにご提供いたします。

クレジットカード決済導入をご検討中のEC事業者さまは、ぜひ一度当社へお問い合わせください。

よくあるご質問

- Q.

- クレジットカードの加盟店審査とは?

- A.

- クレジットカード決済の加盟店審査とは、事業者さまが店舗やECサイトにクレジットカード決済を導入する際に、クレジットカード会社やアクワイアラなどが事業者さまの信用度を調査し審査することです。

クレジットカード会社の損失を避けるために、加盟を希望する事業者さまの営業実態や支払い能力などを審査します。

- Q.

- クレジットカードの加盟店審査の内容は?

- A.

- ECサイトの場合、クレジットカードの加盟店審査では、ECサイトの状況や提供する商品・サービス、経営実績について審査を行います。ECサイトが完成していない場合は、詳細が確認できる資料を提出して審査を受けることもできます。

- Q.

- クレジットカードの加盟店審査に落ちる原因は?

- A.

- クレジットカードの加盟店審査に落ちる原因としては、ビジネスの実績がない、信用情報に問題があるといったものが考えられます。また、特定継続的役務を提供している場合や、公序良俗に反する場合、クレジットカード会社がリスクが高いと判断するビジネスを行っている場合も、審査に落ちる可能性があります。特定継続的役務とは、特定商取引法によって指定された、「エステ」「美容医療」「語学教室」「家庭教師」「学習塾」「結婚相手紹介サービス」「パソコン教室」の7つのサービスです。

その他のご不明点はFAQ よくあるご質問をご確認ください。