ビジネス成長へ

貢献するオンライン決済プラットフォーム

あらゆるビジネスやデバイスに対応し、

安心でスムーズなオンライン決済体験を提供

導入企業様

オンライン決済体験を向上

ユーザーが望む決済手段により

カゴ落ちを抑制

当社では40種類以上のブランドの決済手段を提供しています。そのため、事業者さまのユーザー層に合った決済手段の導入を実現し、カゴ落ちを防止します。

シンプルな画面で

スムーズな購買体験

シンプルで様々なデバイスに対応した決済画面のため、カゴ落ちを抑制し、売上に貢献します。また、API組み込みにより事業者さまの独自UIでの構築も可能です。

アクセス集中時も安定した

決済処理を提供

年間9兆円を超える大規模な決済量を処理する高度な決済システムをご提供しております。そのため、突発的な大量アクセスにも耐えられ、売上の機会損失を軽減します。

機会損失を防ぐ

セキュリティ

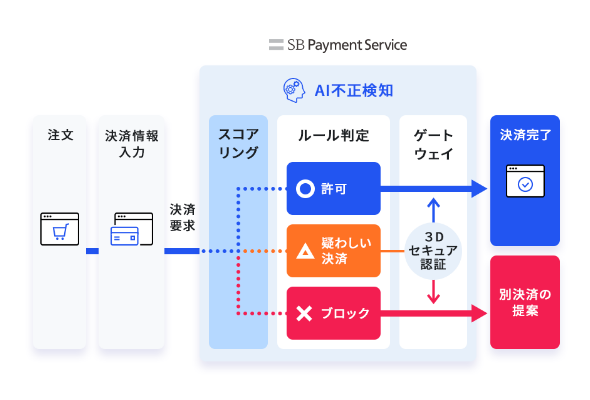

疑いのあるユーザーへの追加認証

による機会損失の軽減

年間数億件を超える決済データとあらゆる不正パターンの機械学習により、クレジットカード決済の不正利用が疑われる取引にのみ追加認証を行い、リスク軽減とカゴ落ち防止いたします。

- ※プランにより機能が異なります。

- ※クレジットカード決済における不正防止サービスです。

様々なビジネスに適応

幅広い支払いオプションを提供しているため、ユーザーが期待する体験を提供できます。

-

BtoC

ECサイト、デジタルゲーム、賃貸料など消費者の支払いに対応いたします。

-

BtoB

請求書払いはもちろん、法人カード決済にも対応いたします。

-

CtoC

個人間取引における料金支払いの決済と売上の振込の両方に対応いたします。

-

サブスクリプション

定額の継続的な課金や料金が異なる継続的な課金(サービスの利用量に応じた課金など)にも対応いたします。

手軽にECカートに決済導入

負担少なく決済導入が可能

対応している20種類以上のECカートでは、開発負担少なく、簡単に決済サービスがご利用できます。また、メールリンク決済ではECサイトがなくても決済が導入可能です。

カート一例

決済導入をご検討の方は

お気軽にお問い合わせください

各種サービスに関する詳しい資料ダウンロードから、費用や導入に関するご相談はお問い合わせより承ります。

ビジネス課題の解決への貢献

-

キャッシュフローの改善

入金サイクルを早くし、事業者さまのキャッシュフローを改善します。1か月間で2~6回の売上入金ができる「早期・複数回入金オプションを提供しています。

- ※お申し込みに際し、事前審査がございます。なお、早期・複数回入金をご利用にあたっては別途、諸費用をいただきます。

-

スムーズなオンライン店舗連携

店舗とオンラインの決済情報を連携することで、シームレスな購買体験を実現します。

店舗向け決済DXプラットフォームの詳細はこちら -

エンタープライズ向け

カスタマイズプラットフォームビジネスにおける管理や支払いのカスタマイズや大規模な決済システム切替など、エンタープライズ向けに柔軟に対応いたします。

モデルケース

オンライン決済導入の流れ

-

事業者さま お問い合わせ

法人名、連絡先、導入希望の決済手段(クレジットカード決済、コンビニ決済など)などをフォームに入力いただきます。

-

当社(SBPS) ヒアリング・お見積り提示

審査・お見積・課金/売上方式・開発要件などに必要な導入予定サービスの情報をヒアリングし、ご要望に沿ってお見積りを作成いたします。

-

事業者さま お申し込み

お申込みフォームに必要情報の入力および必要書類のアップロードいただきます。

-

当社(SBPS) 審査

ご利用になる決済手段について、一括での審査が可能です。ただし、審査内容は決済機関によって異なります。

-

当社(SBPS) システム構築

当社にて事業者さま専用の決済システムを構築しご提供いたします。構築期間は決済手段や設定情報により、数日~2週間程度かかります。

なお、当社では「共用試験環境」を用意しているため、事業者さま専用の決済システムが構築されるまでに、「共用試験環境」にて接続開発を先に行えます。 -

事業者さま システム接続/ご利用開始

事業者さまのサイトと事業者さま専用の決済システムを接続するために、開発を行っていただきます。開発言語としましては、HTTP GET/POSTの送受信ができるものであれば、原則可能となります。システム接続が完了後、ご導入の決済手段にてお支払いを受けつけられるようになります。

決済導入をご検討の方は

お気軽にお問い合わせください

各種サービスに関する詳しい資料ダウンロードから、費用や導入に関するご相談はお問い合わせより承ります。