最近、話題に上がることが多い「◯◯Pay」ですが、キャッシュレス決済の種類では「QRコード決済」、あるいは「バーコード決済」というジャンルに分類されます。提供開始から日が浅く、市場規模はクレジットカードや電子マネーに比べてまだ小さめですが、政府のキャッシュレス推進事業や各社の大規模キャンペーンが後押しとなり利用者数は増加傾向にあります。本コラムでは、当社で実施したアンケートを元にQRコード決済の認知率や利用状況、また利用するお客さまと店舗事業者さまそれぞれのメリットを解説いたします。

目次

QRコード決済とは?

QRコード決済とは、その名のとおり「QRコードを用いて決済を行う手段」のことです。QRコードは別名「マトリックス型二次元コード」と呼ばれており、縦線だけのバーコードよりも多くの情報が読み取れるコードとして開発されました。

QRコード決済の決済方式としては、店舗側が読み取り用のQRコード決済を表示しお客さま側が読み込む「ユーザースキャン方式」と、お客さまが専用アプリでQRコードを表示し事業者さまが読み込んで決済する「ストアスキャン方式」のどちらかとなります。

どちらの方式であっても、お客さまはQRコード決済アプリに紐づけたクレジットカードや銀行口座からチャージした残高を利用して支払いを行います。

各QRコード決済の認知率と利用状況

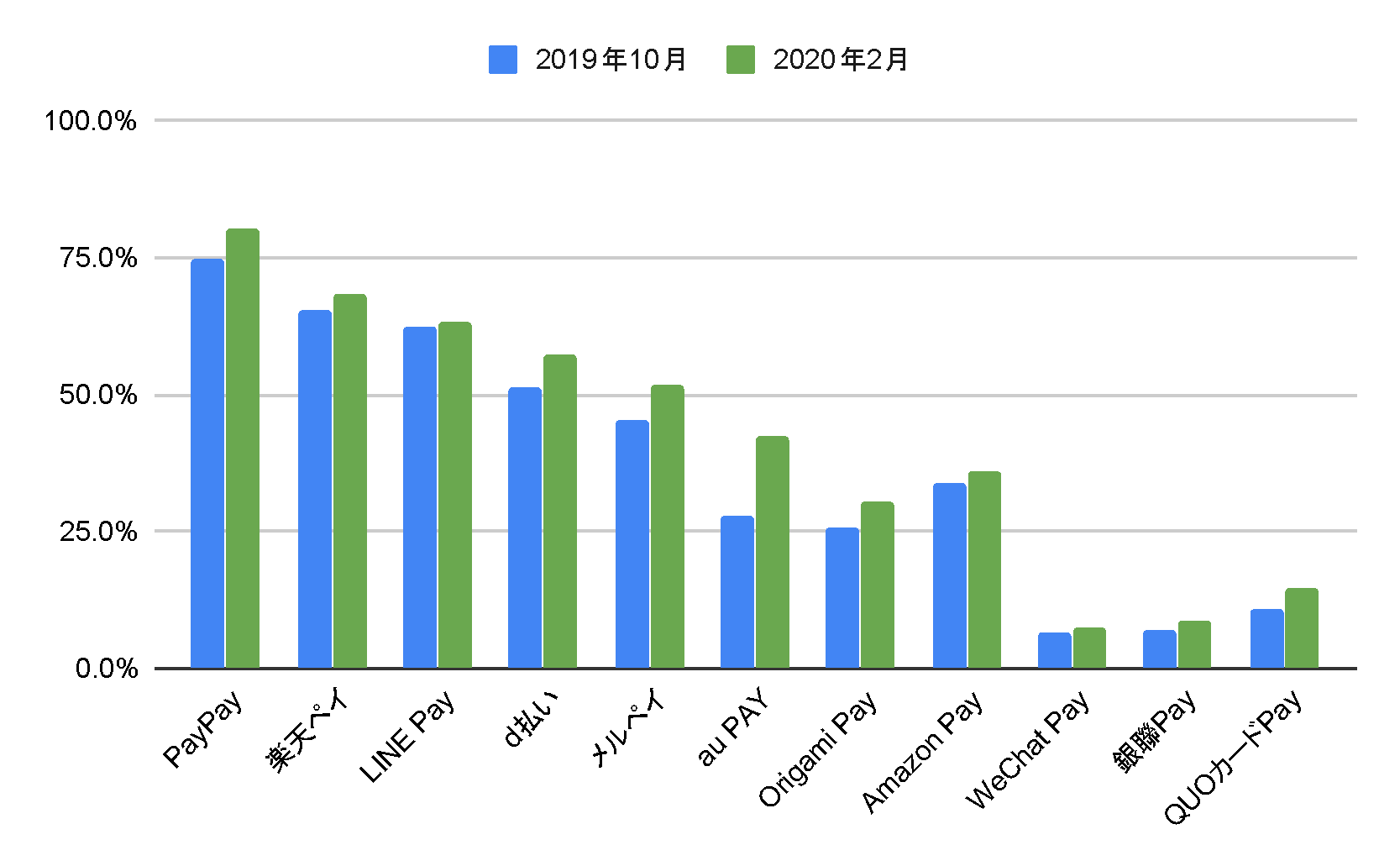

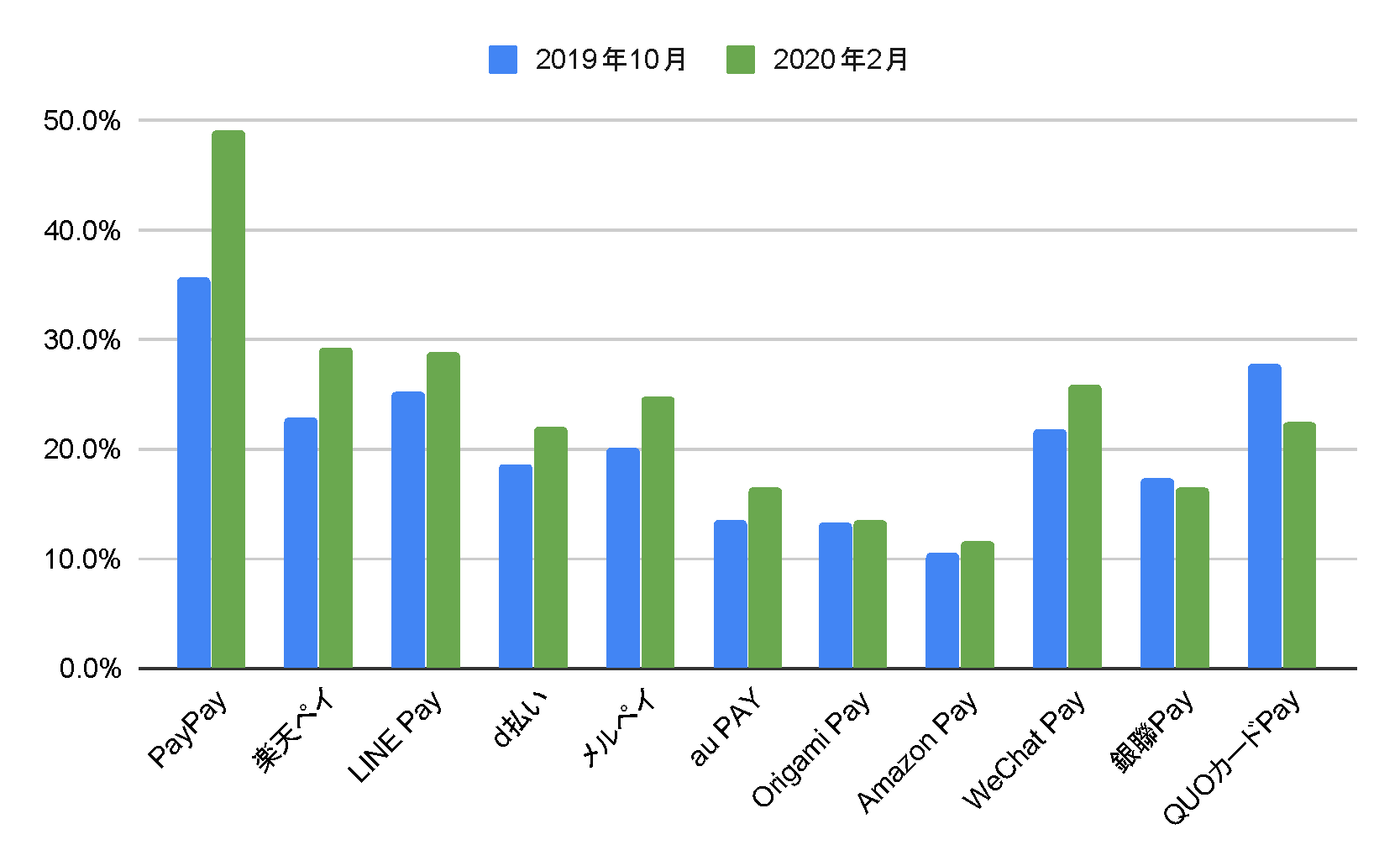

当社では2,200名の同じ対象者に対し、政府によるキャッシュレス還元事業が開始された直後の19年10月時点と、途中経過である20年2月時点で、各QRコード決済の認知率と利用状況に関してアンケートを実施しました。この期間を比較して見えてきた、QRコード決済の状況を解説いたします。

| 対象 | 20歳~60歳以上の男女 2,200名 |

| 期間 | (第1回アンケート)2019/10/03~2019/10/07 |

| (第2回アンケート)2020/02/07~2020/02/09 | |

| 調査方法 | インターネットリサーチ |

| 調査元 | SBペイメントサービス株式会社 |

各QRコード決済の認知率はすべて上昇

Q.次のQRコード決済サービスのうち、あなたがご存じのものを教えてください。(n=2,200;複数回答)

各QRコード決済の認知率を調査したところ、今回調査した各QRコード決済すべてにおいて認知率の上昇が見られました。10月時点で最も認知率が高い「PayPay」では、既に75.0%と高かったものの、2月時点ではさらに上昇し80.5%まで上昇していました。また、認知率の伸び率が最も高かったQRコード決済は「au PAY」で、28.0%から42.3%と14.3%という大幅な上昇が見られました。今後も、各社プロモーションやキャンペーンなどが継続的に行われていく中で認知率が高まることが予想されます。

QRコード決済で支払いをしたことがある割合は最大13.6%増加

Q. 次のQRコード決済のご利用状況を教えてください。(n=2,200;複数回答)

キャッシュレス還元事業が開始した19年10月と比較すると、20年2月では認知率と同様、実際に支払いに利用した割合も増加していました。利用率が最も高かった「PayPay」では、35.6%から49.2%と13.6%の増加率が見られました。この間で各社キャンペーンなども実施しており、それも利用率増加の後押しとなっているのでしょう。

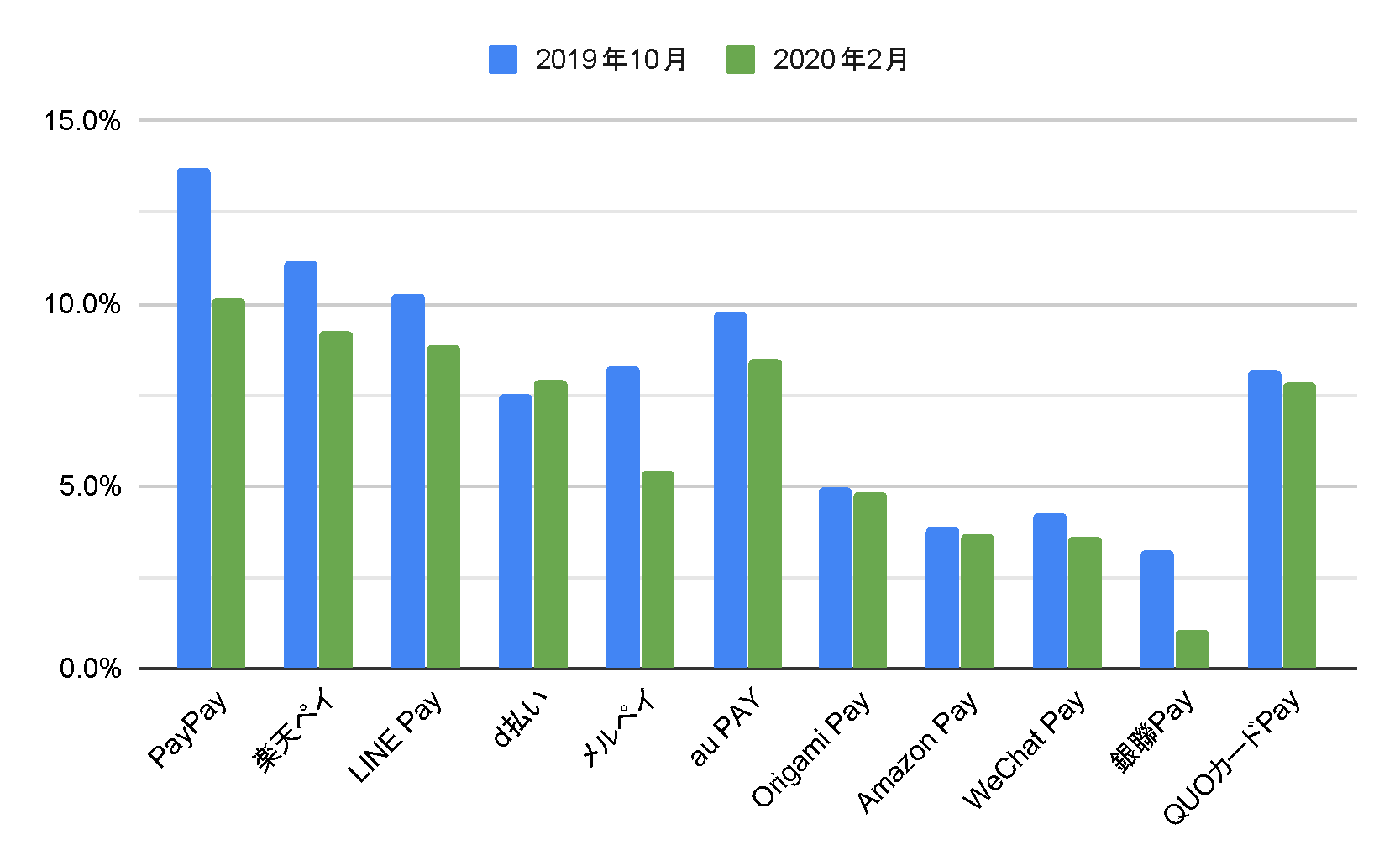

アプリインストール後の未利用者は減少

Q.次のQRコード決済サービスのうち、アプリをインストールしたが支払いに利用したことがないものを教えてください。(n=2,200;複数回答)

19年10月まではQRコード決済アプリをインストールしたが、支払いで利用していないという割合も一定数いましたが、2月時点ではほぼすべてのQRコード決済において、利用していない割合は減少していました。インストールしたが利用していないという背景には、使える店舗が身近になく利用しないなどという理由もありましたが、キャッシュレス還元事業の後は利用できる店舗が大幅に伸びたため利用していない方が減少したと思われます。

お客さまがQRコード決済を利用するメリット

利用するお客さまが実際に増えていることは上述でご紹介しましたが、どういったメリットがあり利用されているのかを解説いたします。

手軽な決済が可能

QRコード決済は、現金でやりとりする手間を省くのはもちろんのこと、クレジットカード決済のようなクレジットカード番号を打ち込んだりサインを書いたりする行為が不要なため、店舗でスムーズに決済できる点が強みです。

加えて、いつどこで何を買ったのかアプリ内に記録が残るため、家計簿のように使うこともできます。

キャンペーン優遇やポイントが受けられる

QRコード決済サービスは、還元キャンペーンが行われていたり独自のポイントをつけている会社もあるため、お客さまにとっては他の決済手段で支払うよりお得になることがあります。

また前述した政府によるキャッシュレス還元事業では、対象の店舗での利用時に2%~最大5%の還元が受けられるため、事業の期間中はよりメリットを感じやすいでしょう。

若年層のお客さまにも利用が可能

クレジットカードのようにカード発行にあたっての審査がないため、18歳未満のお客さまでもアカウント開設・利用することができます。また残高をプリペイド方式でチャージできるQRコード決済では、あらかじめ使う分だけチャージしておけば使いすぎを防ぐこともでき安心してお使いいただけます。

店舗事業者さまがQRコード決済を導入するメリット

お客さまに多くメリットがあるQRコード決済ですが、店舗事業者さまにとっても同様にメリットがあります。

新規顧客の獲得

店舗事業者さまがQRコード決済を導入するメリットで大きいのは、新規顧客を獲得できることです。前述のとおり、QRコード決済を利用するお客さまはどんどん増えています。またキャンペーンやポイント還元を狙って、積極的にQRコード決済ができるお店を利用するお客さまもいますので、そうしたお客さまを獲得できる可能性が高まるでしょう。

インバウンドビジネスの拡大

外国人観光客にとってもQRコード決済は魅力的なサービスです。観光庁が発表した2019年の訪日外国人旅行消費額(速報・推計)は、4兆8113億円に上り、前年比で6.5%の増加となりました。2020年の東京オリンピック・パラリンピックに向けて、さらに増加が見込まれています。

訪日外国人のうち、最も多いのは年間900万人以上来日する中国人ですが、中国はキャッシュレス先進国です。中国でよく使われている「Alipay(アリペイ・支付宝)」や「WeChatPay(ウィーチャットペイ・微信支付)」に対応することで、インバウンドビジネスの可能性が広がるでしょう。

レジ業務の煩雑さ減少

支払い時のオペレーションが楽になり、レジ業務の煩雑さが減少することも見逃せないメリットです。QRコード決済で発生する作業は、前述で記載したとおり、お客さまか店舗側のどちらかがQRコードを読み取り、金額を入力するだけ。場合によってはお客さまがレジに来る必要すらないため、レジ業務が非常に楽になるでしょう。飲食店におけるQRコード決済は、現金を扱う必要がなくなるため、衛生面でも大きなメリットがあります。

店舗事業者さまがQRコード決済を導入するデメリット

ここまでお客さまと事業者さまのメリットをご紹介しましたが、導入するにあたっては実際にはデメリットも存在します。事業者さまはデメリットにおいてもしっかりと把握されることが重要となりますのでここでご紹介いたします。

導入/運用費用がかかる

QRコード決済においても、他のキャッシュレス決済と同様に初期・月額費用・決済手数料等が発生します。各QRコード決済によって、これらの費用は異なるため、導入時に各社の費用を比較することが重要です。

売上金額入金までのタイムラグ

店舗事業者さまのQRコード決済のデメリットは、お客さまの支払いから実際に売上金額が入金されるまでタイムラグが発生することです。常に現金が一定程度必要な事業者さまの場合は、この点は考慮し導入する必要があります。

ユーザースキャン方式での注意点

決済を行う上ではセキュリティ面で十分対策されているQRコード決済ですが、店舗側が用意したQRコードをお客さまに読み取ってもらう「ユーザースキャン方式」の場合には注意が必要です。中国では2017年頃より、店舗のPOPなどに掲示してある決済用のQRコードを、別のものに差し替えられる事件が発生しています。ただし、これは前述のお店側がお客さまの表示したQRコードを読み取る「ストアスキャン方式」なら防ぐことができます。

主要なQRコード決済の特徴

ここからは、各社が提供している主要なQRコード決済サービスの特徴を簡単にご紹介します。

PayPay

- ・ソフトバンクとヤフーの合弁会社であるPayPayが提供するQRコード決済サービス

- ・リリース直後の「100億円キャンペーン」が話題になり、ユーザー数は2,300万人を突破(2020年1月17日時点)

- ・定期的にポイント還元キャンペーンを実施しており、お客さまの利用率が高いことが特徴

d払い

- ・NTTドコモが提供するQRコード決済サービス

- ・ドコモの携帯利用料金と合算して支払うことが可能

- ・支払い金額に応じてdポイントが貯まり、dポイントカードと併用することで、ポイントをダブルで獲得できるのが強み

Alipay(アリペイ・支付宝)

- ・中国のアリババが提供するサービス

- ・多くの中国人が利用しており、導入することでインバウンドビジネスに期待ができる

- ・中国のモバイル決済市場の内Alipayが占めるシェアは50%以上であり、最もメジャーな決済手段といえる

QRコード決済は複数サービスを一括導入するのがおすすめ

本コラムにてご紹介したもの以外にも、さまざまなQRコード決済があり、現在はお客さまがそれぞれのライフスタイルに応じて選択している状況です。そのため、店舗事業者さまにとっては「これだけ導入すればOK」というわけではなく、できるだけ多くのサービスに対応しておくことが重要でしょう。

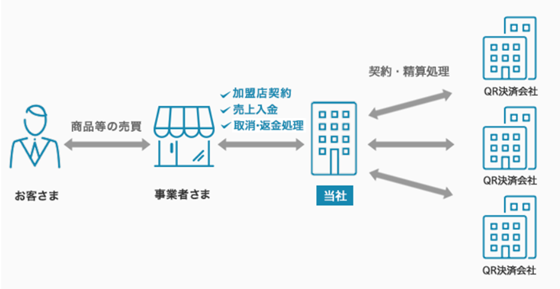

しかし、一つひとつの運営会社と契約して運用するのは、かなりの手間がかかり現実的ではありません。そこでご活用いただきたいのが決済代行会社です。導入から運用・入金まで一括で代行してくれるため、忙しい事業者さまの負担を減らすことができます。

【決済代行会社を利用する際のQRコード決済の仕組み】

SBペイメントサービスが選ばれる理由

当社では、決済代行会社として現在10社のQRコード決済の取り扱いを行っております(20年2月時点)。またこの10社のQRコード決済をひとつの端末で決済できるコード決済サービスをご提供しており、事業者さまのニーズに合わせて4種類からお選びいただけます。

| コード決済アプリ「S!can」 | 事業者さまのスマートフォンかタブレット端末にS!canアプリをインストールしていただき、カメラ機能でQRコード決済を読み取り決済を行います。 |

|---|---|

| コード決済専用端末「SUNMI」 | 事前にS!canアプリがインストールされている端末機をご提供し決済を行います。レシートプリンタも内蔵のため、印字が必要な事業者さまにおすすめです。 |

| API方式 | 当社のAPIを活用して既存のレジ(POS)システムと決済システムを連動させ、レジのコードリーダーでお客さまのQRコードを読み込むことで決済を行います。 |

| マルチ決済端末「VEGA3000」 | 1台でクレジットカード・電子マネー・QRコード決済に対応。レシートプリンタも内蔵されており、幅広く決済を導入されたい事業者さまにおすすめです。 |

当社は、オンライン決済・店舗決済含め多くの導入実績がありますので、事業者さまの課題に応じたご提案をさせていただきます。ご検討の際には、当社までお気軽にお問い合わせください。

※「QRコード」は、株式会社デンソーウェーブの登録商標です。

※その他、記載されている会社名および商品・サービス名・ロゴは、各社の商標または登録商標です。