コンビニ決済は1回の決済ごとに、決済額に応じて手数料がかかるのが一般的です。事業者さまとお客さまのどちらがコンビニ決済の手数料を負担するかは、コンビニ決済の導入時に決めることができます。コストや利便性などを踏まえ、慎重に判断するようにしてください。

そこで本記事では、コンビニ決済の手数料はいくらなのかを解説します。事業者さまがコンビニ決済を導入するメリット・デメリットのほか、手数料の負担先の決め方と、コンビニ決済の導入の流れについても詳しく見ていきましょう。

目次

コンビニ決済の手数料

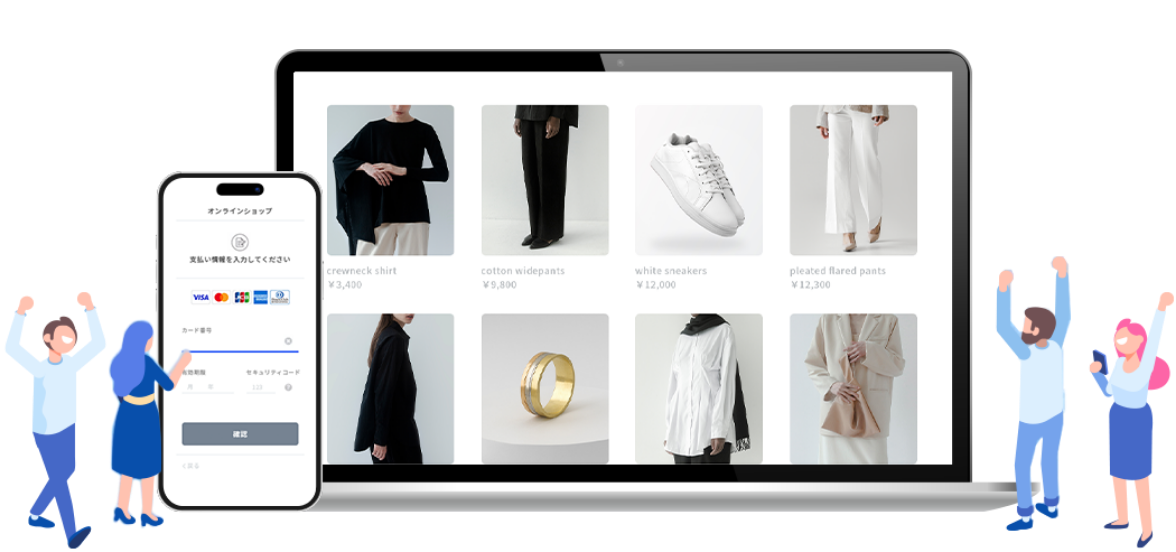

コンビニ決済とは、ECサイトでお客さまがお買い物をされた際に発行される特定の番号を使って、全国の主要コンビニエンスストアで商品代金を支払う決済サービスのことです。

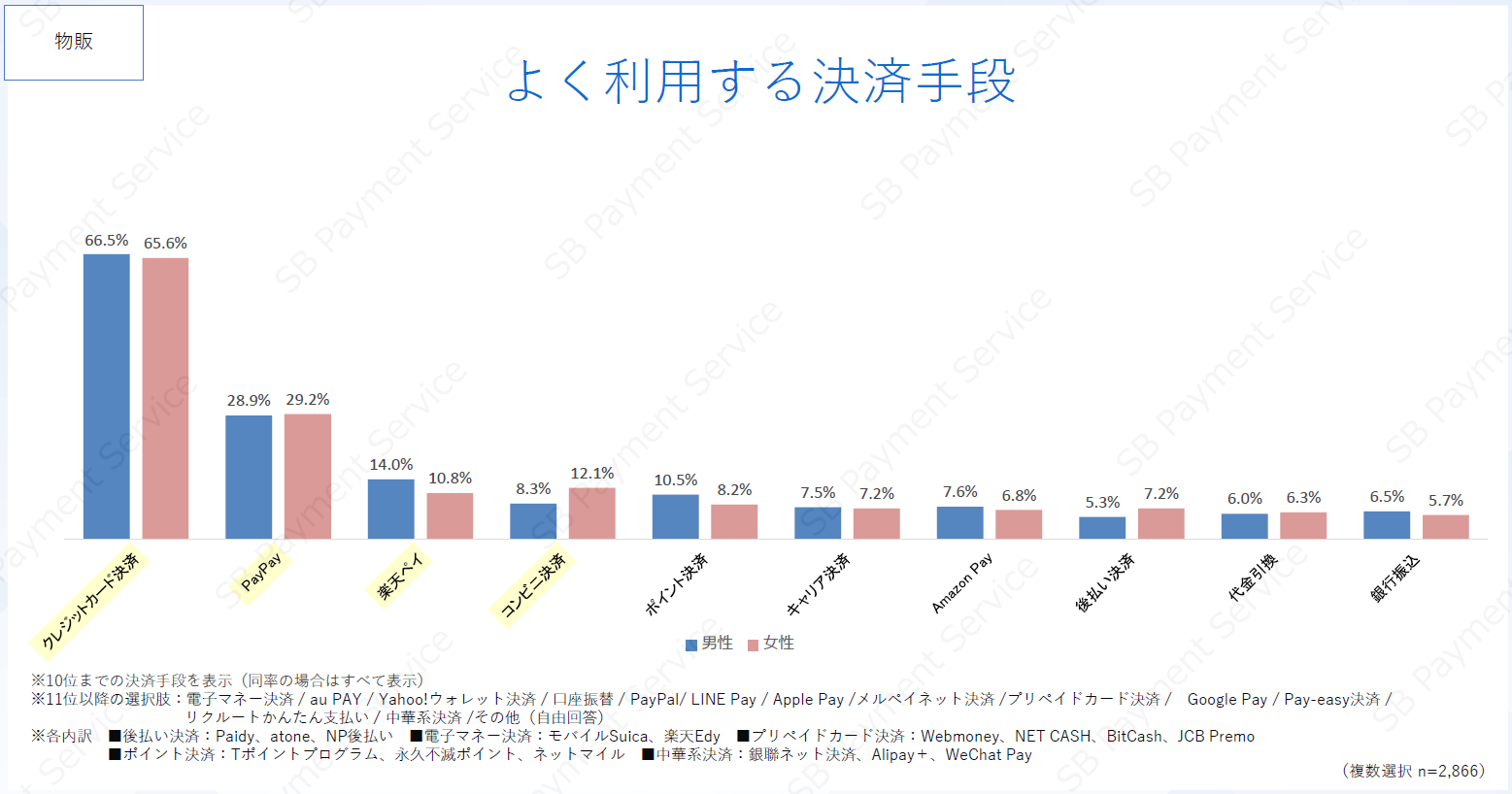

コンビニ決済は、ECサイトにおける物販では4番目に多く利用されている決済方法であり、約10%のお客さまがよく利用しています。

ネットショップでよく利用する決済手段(複数回答)

出典:SBペイメントサービス「【2024年度版】5回目となる決済手段のEC利用実態調査結果を公開」(2024年7月)

事業者さまがコンビニ決済を導入する場合には、所定の費用がかかります。事業者さまがコンビニ決済を導入される場合に、必要となる費用は以下のとおりです。

なお、各費用は業種や決済代行会社によって異なりますので、導入される際にご確認をおすすめします。

- ・初期費用

- ・月額費用

- ・1決済あたりの手数料

1決済あたりの手数料に関しては、1回あたりの決済額で金額が決まります。1決済の上限が30万円未満で、100~600円程度の決済手数料が必要です。

ご参考までに、コンビニ決済と異なりクレジットカード決済などの多くの決済手段は、商品代金に対して数パーセントが1決済あたりの手数料となります。例えば、1万円の商品代金をクレジットカード決済で販売すると、1~10%前後の手数料が必要になるため、事業者さまにお支払いいただく金額は100〜1,000円程度です。

コンビニ決済については、以下の記事で詳しく説明しております。

コンビニ決済とは?仕組みやメリットを解説 | SBペイメントサービス

コンビニ決済の手数料の負担先を決める際の考え方

コンビニ決済を導入する際は、事業者さまとお客さまがどのように手数料を負担するかを、事業者さまが決められます。コンビニ決済の手数料の負担先を決める際は、コスト面の負担を踏まえて考えることが大切です。

手数料を全額事業者さまの負担とすればお客さまの負担はなくなりますが、決済ごとにコストがかかるため注意が必要です。一方、お客さまが支払う手数料の比率を高めるほど事業者さまのコスト面での負担は軽減される反面、購入を敬遠するお客さまが現れる可能性があります。

手数料の負担先は、このようなメリットとデメリットを踏まえて慎重に検討しましょう。

コンビニ決済の手数料は、事業者によって異なる

コンビニ決済の手数料は、商品・サービスを提供する事業者によって異なります。例えば、Amazonでは商品を購入し、代金をコンビニ決済で支払った場合のお客さま側の手数料は無料です。コンビニ決済の手数料が無料のサービスはほかにもありますので、詳細は事業者のWebサイトを確認してください。

コンビニ決済の手数料が有料のケースでは、お客さまはコンビニエンスストアごとに定められた手数料を支払う必要があります。具体的な金額はコンビニエンスストアごとに異なりますが、決済額が1万円未満であれば110円程度になります。詳細は、コンビニエンスストアのWebサイトなどで確認してください。

コンビニ決済の支払い方法と、事業者さまが負担する手数料

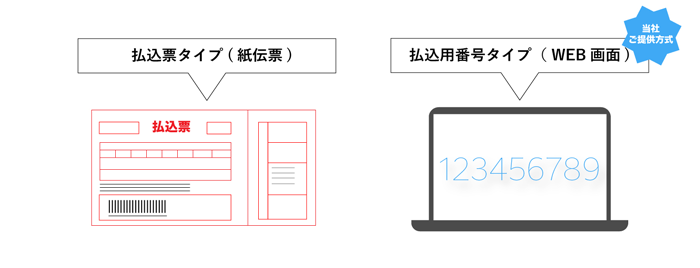

コンビニ決済の支払い方法は、一般的に「払込票タイプ」と「払込用番号タイプ」の2種類があり、支払い方法によって事業者さまが負担する手数料が異なります。

払込票タイプ

払込票タイプは、事業者さまがバーコードや商品の金額、支払い期日が記載された払込票をお客さまにお送りし、お客さま自身が払込票をコンビニエンスストアのレジで提示し、商品代金をお支払いいただく方法です。

事業者さまが振込票を印刷したり、発送したりする事務作業の手間がかかるものの、幅広い世代のお客さまにとってなじみのある支払い方法のため、抵抗なくご利用いただける方法といえます。

払込票タイプの利用金額・手数料・費用の例(事業者さま負担分)

| 利用金額 | 1決済あたりの手数料 | 初期費用 | 月額費用 |

|---|---|---|---|

| ~30万円程度 | 100~300円程度 | 0~数万円程度 | 0~数万円程度 |

払込用番号タイプ(オンライン支払番号発行方式)

払込用番号タイプ(オンライン支払番号発行方式)は、お客さまがECサイトで購入される際、ECサイトに表示された決済に必要な各種番号を、コンビニエンスストアのレジでお伝えいただくか、設置されている専用端末に入力して発券された払込票をレジにご提示いただくことで代金をお支払いいただく方法です。

事業者さまは払込票をお客さまにお送りする必要がなく、事務負担が発生しない点がメリットといえます。

払込用番号タイプ(オンライン支払番号発行方式)の利用金額・手数料・費用の例(事業者さま負担分)

| 利用金額 | 1決済あたりの手数料 | 初期費用 | 月額費用 |

|---|---|---|---|

| ~30万円程度 | 100~600円程度 | 0~5万円程度 | 0~1万円程度 |

SBペイメントサービスでは、後者の払込用番号タイプ(オンライン支払番号発行方式)を提供しています。

▼SBペイメントサービスのコンビニ決済サービスについて詳しく知りたい方はこちら

コンビニ決済代行サービスの導入ならSBペイメントサービス

全国の主要なコンビニエンスストア店頭でお支払いいただけて、どなたでも使える決済手段

事業者さまがコンビニ決済を導入するメリット

事業者さまにとって、コンビニ決済にはいくつものメリットがあります。ここでは、代表的な4つのメリットをご紹介します。

売上向上が見込める

コンビニ決済の最大のメリットは、売上向上が見込める点です。24時間365日支払いが可能なコンビニ決済は、お客さまにとって便利な決済手段であるため、販売促進効果が見込めます。

通勤・通学などの途中にコンビニエンスストアに立ち寄って支払いを済ませるなど、ライフスタイルに合わせて幅広いお客さまにご活用いただける決済方法といえるでしょう。

クレジットカードを持たない層をターゲットにできる

コンビニ決済は、クレジットカードを持たない層を、ECサイトのターゲットにできるという点もメリットのひとつといえます。当社が2024年に行った調査によると、インターネットで商品を購入した際にコンビニ決済を選択するお客さまは、全体の約10%です。コンビニ決済を選択する主な理由は、「クレジットカードを持っていない」「コンビニエンスストアが多くて便利」といったことです。コンビニ決済を導入すれば、こうしたお客さまを取り込めるようになるでしょう。

クレジットカード決済がECサイトでの商品購入を躊躇する主な理由となっていたお客さまを新規顧客として取り込むことで、ターゲット層を拡充できる可能性があります。

入金確認がスピーディーに行える

入金確認をリアルタイムでスピーディーに行えることも、コンビニ決済を導入するメリットのひとつです。金融機関などの場合、オンライン口座を開設していなければ窓口の営業時間に入金確認を行うしかありません。

一方、コンビニ決済であれば、入金後数分から1時間程度経てば管理画面上で入金状況を確認できます。スピーディーな入金確認が可能になることは、事業者さまにとってコンビニ決済を導入する大きなメリットといえるでしょう。

未払いが防止できる

未払い防止につながることも、コンビニ決済を導入する重要なメリットのひとつです。コンビニ決済による支払い確認後に商品を発送する前払い制にすることで、未払いのリスクを抑止できます。

また、コンビニ決済の後払いに対して、未払い保証を用意している決済代行会社もあります。このような決済代行会社を利用すれば、万が一後払いで未払いが発生しても事業者さまに損金は基本的に発生しません。未払いを防止し、代金を確実に回収するためにも、コンビニ決済の導入は意義のある対策といえます。

コンビニ決済のメリットについては、以下の記事で詳しく説明しております。

コンビニ決済とは?仕組みやメリットを解説 | SBペイメントサービス

事業者さまがコンビニ決済を導入するデメリット

コンビニ決済にはメリットだけではなくデメリットもあります。コンビニ決済をご導入される際に留意しておきたい点も確認しておきましょう。

決済代行会社を介さない場合、契約や審査手続きが複雑

コンビニ決済を導入するにあたって、契約や審査に関する手続きが複雑になりがちな点がデメリットといえます。決済代行会社を利用せずにコンビニ決済をご導入される場合は、各コンビニ会社と個別に交渉から契約、システムの連携までを行わなければなりません。

さらに、コンビニ会社ごとの審査にも通過する必要があり、これらの手続きは非常に時間も手間もかかります。そのため、多くの事業者さまが決済代行会社を利用しています。

払込票を紛失されたら再発行する必要がある(払込票タイプの場合)

お客さまが払込票を紛失する可能性がある点もデメリットのひとつです。お客さまへ払込票用紙を郵送する払込票タイプの場合、払込票を紛失されたら再発行する必要があります。コストも時間もかかるため、すぐに確認できる払込用番号タイプがおすすめです。

未払いのままキャンセルとなる可能性がある

未払い状態のままキャンセルとなるリスクがあることも、コンビニ決済のデメリットです。コンビニ決済には、支払い期限が設けられます。期限を過ぎた場合、その取引をキャンセルにするお客さまもいます。支払い確認後に商品を発送する前払い制にするか、もしくは後払い決済の未払いを保証している決済代行会社を利用するなど、対策を講じておく必要があるでしょう。

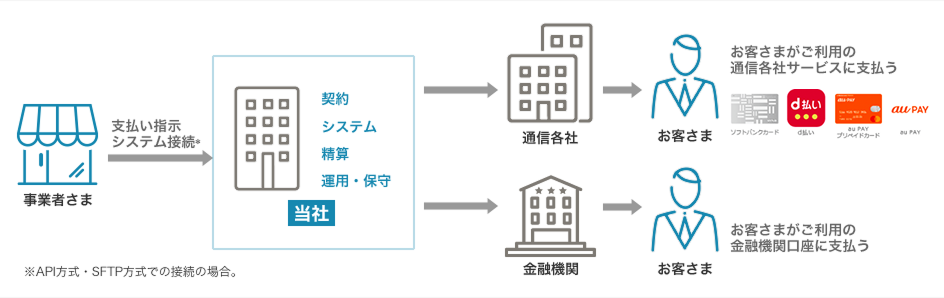

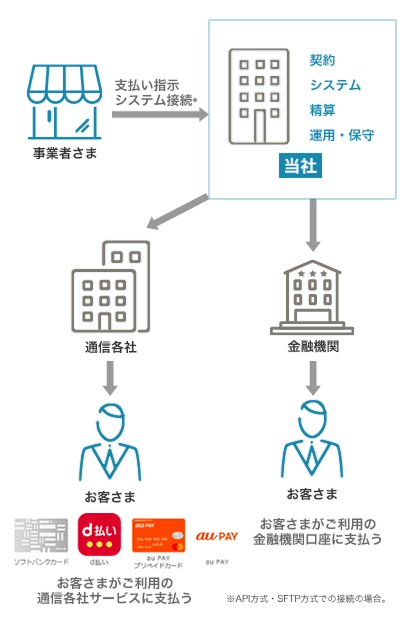

コンビニ決済の仕組みとシステム接続方式

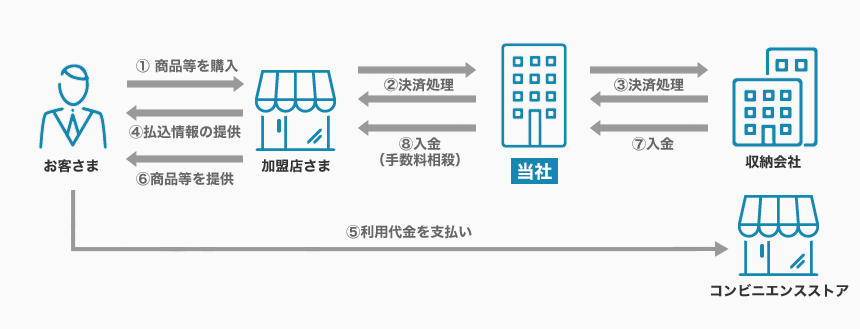

コンビニ決済のフローには、お客さま、加盟店さま(事業者さま)、コンビニエンスストアのほかに、収納会社や決済代行会社が関わっています。決済代行会社を利用したコンビニ決済の決済フローについて、SBペイメントサービスのシステムを例にご説明いたします。

コンビニ決済の仕組み

- (1)お客さまが加盟店さまのECサイトでコンビニ決済を選択して、商品等をご購入

- (2)~(3)当社を通して収納会社で決済処理を実行

- (4)加盟店さまよりお客さまに払込情報を提供

- (5)お客さまは、払込情報をもとに、コンビニエンスストアで代金をお支払い

- (6)加盟店さまよりお客さまへ商品等を提供

- (7)~(8)当社を通して、収納会社より加盟店さまに入金

コンビニ決済の手数料は、当社から事業者さまへの入金時に相殺される仕組みとなっています。

なお、事業者さまに最終的に入金されるタイミングは、コンビニエンスストアによって異なります。これは、各コンビニエンスストアのシステムの都合上、売上の計上タイミングが異なるためです。

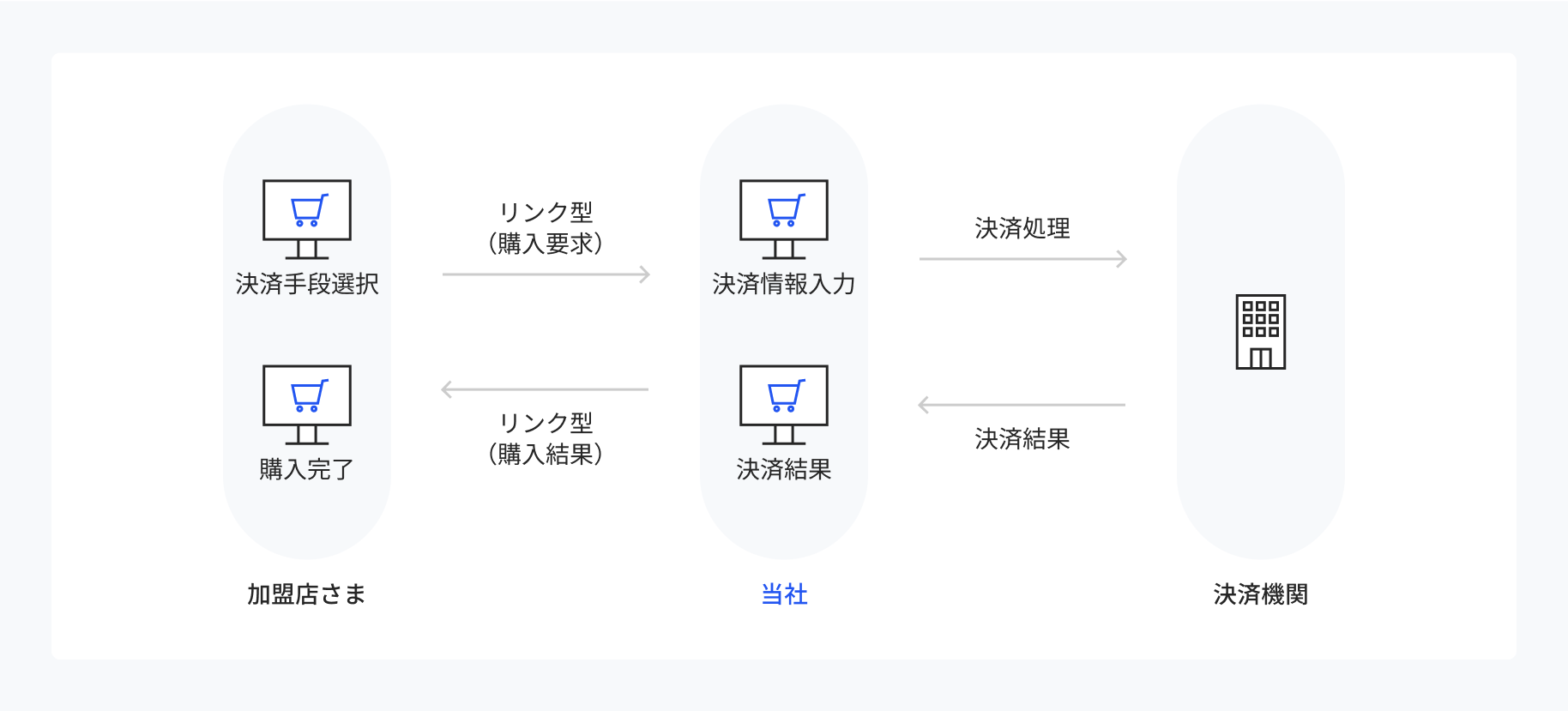

システム接続方式は「リンク型」と「API型」の2種類

ECサイトの支払い方法にコンビニ決済をご導入されるには、ECサイトと決済代行会社のシステムを接続する必要があります。

SBペイメントサービスではシステム接続方式として、開発が少ない「リンク型」と、柔軟なシステム接続が実現できる「API型」の2種類を提供しています。

「リンク型」は、お客さまが商品購入時に当社の決済画面に遷移して決済処理を行う接続方式です。事業者さまが決済画面を構築する必要がないため、開発工数が少なく済むメリットがあります。

リンク型接続イメージ

▼リンク型接続方式については、以下のページで詳しく説明しております。

リンク型 | SBペイメントサービス

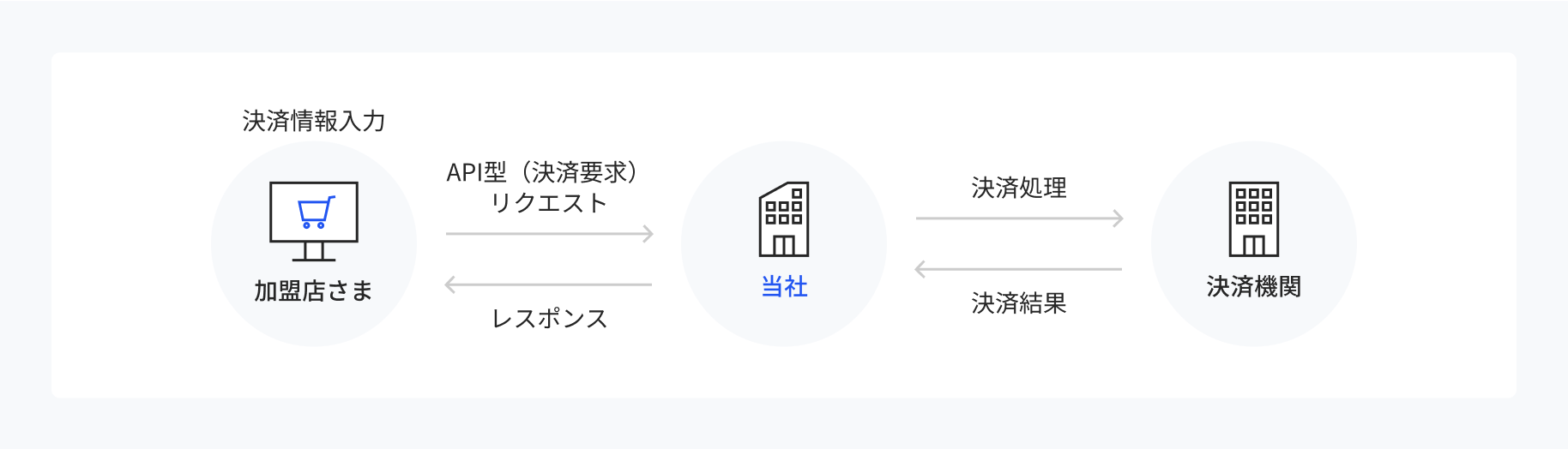

一方、「API型」は決済処理手続き画面を事業者さまでご用意いただき、当社のサーバに対して、商品代金や商品個数などの必要決済情報を通信することにより決済処理を行います。「リンク型」に比べて開発工数はかかるものの、決済画面を自由に設計でき、お客さまはECサイト内で購入手続きを完了できる点がメリットです。

API型接続イメージ

▼API型接続方式については、以下のページで詳しく説明しております。

API型 | SBペイメントサービス

決済代行会社を比較するポイント

コンビニ決済をご導入されるにあたり決済代行会社を利用する場合は、各社の特徴を比較しましょう。比較するポイントには、以下のようなものがあります。

入金のタイミング

コンビニ決済と既存の決済方法の入金タイミングにずれが生じないかどうかは、重要な比較ポイントのひとつです。入金のタイミングのずれが少ないほど入金サイクルが早く済み、事業者さまの業務効率化にもつながります。

反対に、入金のタイミングがバラバラだと、入金消込作業に手間がかかってしまう可能性があります。

決済手数料

決済1件あたりの手数料を確認して、検討中の決済代行会社と変わらないかどうか比較してみましょう。ただし、決済手数料はほとんどの決済代行会社で金額が変わらないため、手数料だけで比較することは難しいかもしれません。

月額費用

月額費用を比較する際は、月額最低費用も確認しましょう。ただし、月額費用が安いからといって、必ずしもお得になるとは限りません。コンビニ決済と既存の決済方法の入金のタイミングが大きくずれると運用の手間も増えて、いくら月額費用が安くても人件費や時間的コストが大きくなってしまう可能性もあるためです。入金のタイミングや決済手数料も含めて比較し、総合的に判断することをおすすめします。

決済代行会社を比較する際は、上記項目のほかにも対応コンビニエンスストアのブランド数や、コンビニ決済と親和性のあるサービスを取り扱っているかどうかに注目することがポイントです。そうすることで、より自社のニーズにぴったりの決済代行会社をご導入されることができます。

決済代行会社の比較例

| サービス事業者 | 入金のタイミング | 決済手数料 | 月額費用 |

|---|---|---|---|

| A社 | 50日 | 150円/件 | 1,000円 |

| B社 | 60日 | 150円/件 | 500円 |

上の例では、決済手数料・月額費用を比較した限り、B社に導入メリットがあるように見えます。ただし、既存の決済手段の入金タイミングとそろっているか確認しておくことが重要です。

例えば、既存の決済手段の入金タイミングが50日の場合、B社を選ぶと入金に10日間のずれが生じることになります。結果として入金の消し込みを行うタイミングもずれ込むため、作業が煩雑になりかねません。A社であれば入金タイミングが既存の決済手段とそろっているため、月額費用がB社よりも500円高くなったとしてもメリットは大きいと考えられます。

このように、費用だけでなく入金のタイミングについても十分に確認し、実務の負担を考慮して決済代行会社を選ぶことが大切です。

SBペイメントサービスが選ばれる理由

コンビニ決済における、当社の強みとしては「主要コンビニエンスストアに対応」「支払代行サービス」「NP後払い」の3点があります。それぞれの内容について、ご紹介いたします。

「主要コンビニエンスストアに対応」

当社のコンビニ決済は全国の主要なコンビニエンスストアに対応しており、多くの事業者さまに選ばれる理由でもあります。セブン-イレブン、ローソン、ファミリーマート、ミニストップ、セイコーマートに対応しており、当社にお申込みをいただくだけで、事業者さまは各コンビニエンスストア店頭でのお支払いを受け付けることができるようになります。

返金がスムーズになる「支払代行サービス」

コンビニ決済ではコンビニエンスストアからお客さまへの返金対応はできず、返金が必要な際は、事業者さまからお客さまに直接返金が必要です。一般的にはお客さまの銀行口座に対して返金をします。この際に事業者さまには、振込手数料や振込作業などの負担が生じます。数件の返金対応であれば大きな負担にはならないかもしれませんが、毎月10件以上になる場合には効率化の方法を考えるべきではないでしょうか。そのような煩雑な返金対応にもご利用いただける支払代行サービスを当社ではご提供しております。事業者さまに代わり当社がお客さまに対して必要金額の振込を行います。事業者さまは当社に指示をすることにより簡単に振込作業を終えることができます。

※コンビニ決済とは別に契約が必要となります。

商品を先に受け取ることができる「NP後払い」

前述のとおり、コンビニ決済はクレジットカード決済に次いで人気の決済ですが、最近では商品が届いた後にコンビニエンスストアでお支払いできるNP後払いも普及しています。

当社では、20万店舗以上に導入されており、後払い決済サービスの中でも圧倒的なシェアを占めているNP後払いを提供しております。コンビニ決済を導入される際には、「NP後払い」もぜひいっしょにご検討ください。上述のとおり、当社では事業者さまのビジネス拡大をご支援するサービスを多くご提供しております。ご導入を検討されている事業者さまは、ぜひ一度お問い合わせください。

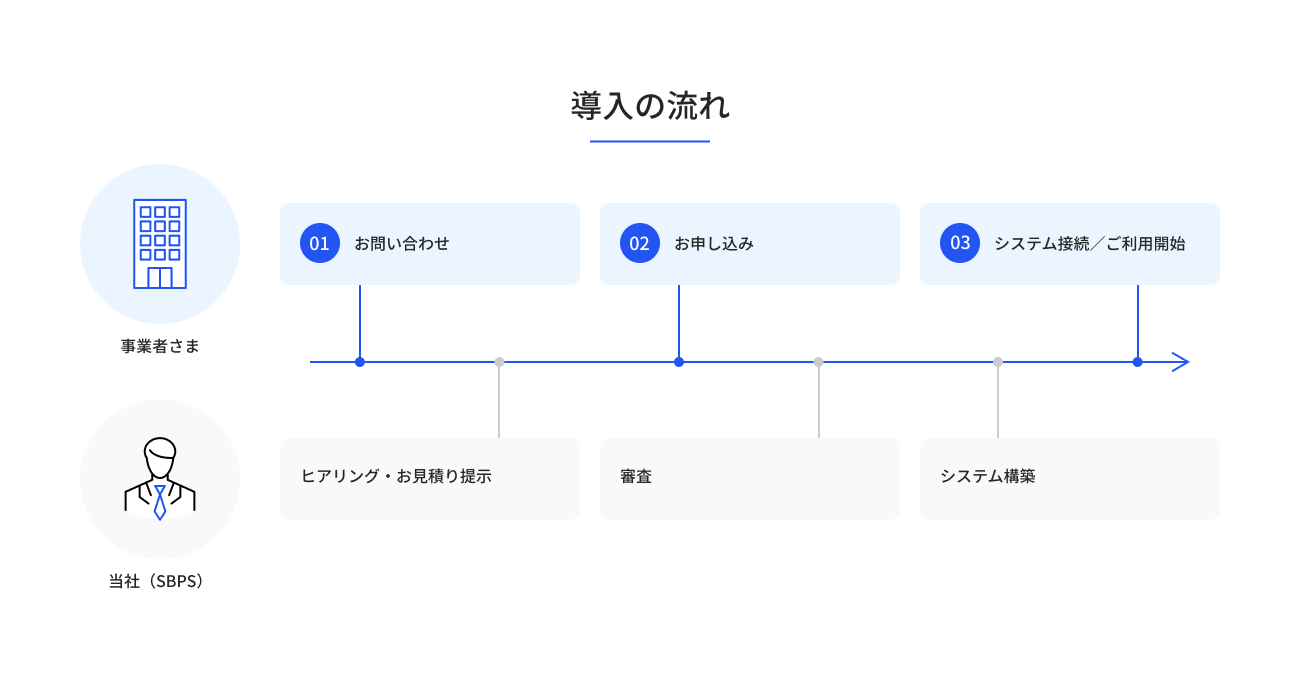

コンビニ決済導入までの流れ

SBペイメントサービスのクレジットカード決済代行サービスにお申し込みいただいた場合、ご利用開始までのお手続きは、以下のフローに沿って進めさせていただきます。

※必要書類が不足している場合は、審査を受けることができないためご注意ください。

※必要書類については、お申し込み時にSBペイメントサービスの営業担当よりご案内いたします。

詳細なご導入手順と費用は以下のページをご確認ください。

オンライン決済サービス導入までの流れ・手順

よくあるご質問

- Q.

- コンビニ決済とはどのような種類がありますか?

- A.

- コンビニ決済の種類は、一般的に「払込票タイプ」と「払込用番号タイプ」の2種類があります。

- Q.

- コンビニ決済にかかる費用(手数料)とは?

- A.

- EC事業者さまにかかる費用は、「初期費用」「月額費用」「1決済あたりの手数料」などです。初期費用は0~5万円程度、月額費用は無料~1万円程度、1決済あたりの手数料は100~600円程度のケースが多く見られます。

一方、お客さまが負担する手数料は、1回あたり0~200円程度です。ECサイト事業者さまが手数料をどの程度負担するかによって、お客さまが負担する手数料は異なります。お客さまの手数料が0円になるケースがあるのは、ECサイト事業者さまが手数料を全額負担しているからです。

- Q.

- コンビニ決済の手数料を負担するのは誰?

- A.

- コンビニ決済の手数料を誰が負担するかは、コンビニ決済を導入する際に事業者さまが選択可能です。事業者さまが負担するようにすれば、お客さまにとっての利便性は高まりますが、事業者さまのコストが大きくなります。お客さまの負担にすれば、事業者さまの負担が軽くなる分、コンビニ決済の利用率が下がり機会損失につながるかもしれないため、慎重に検討してください。

その他のご不明点はFAQ よくあるご質問をご確認ください。