クレジットカードはお客さまにとってもEC事業者さまにとっても便利である反面、不正利用のリスクもあります。クレジットカードの不正利用の手口はさまざまですが、そのほとんどは簡単な対策で未然に防ぐことが可能です。

ここでは、クレジットカードに関する不正利用の発生状況や手口のほか、お客さまとEC事業者さまがとるべき対策についてご説明します。

目次

クレジットカードの不正利用は増えている?

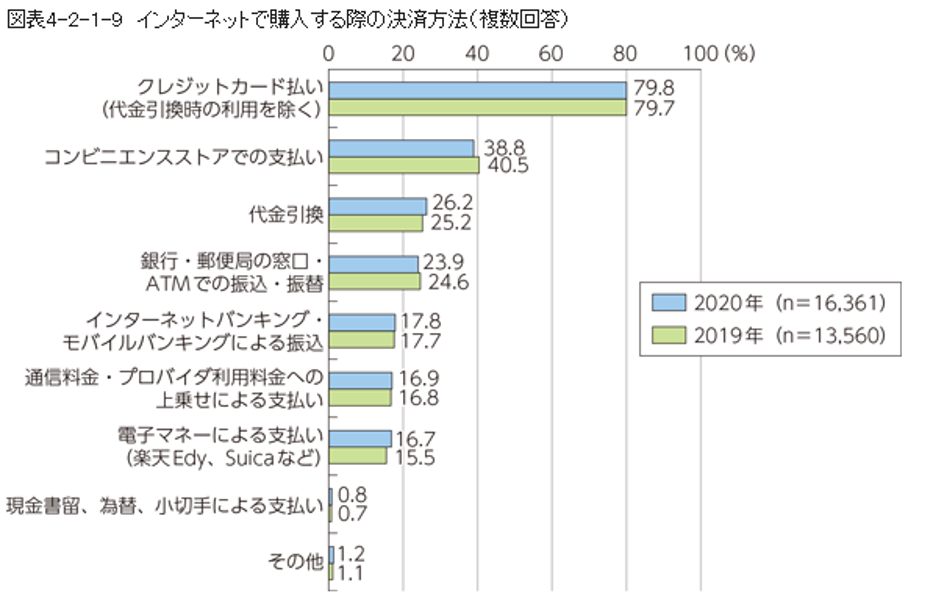

ECサイトにおいて、クレジットカード払いは重要な決済手段です。総務省の「令和3年版 情報通信白書」によると、「インターネットで購入する際の決済方法」という設問では、「クレジットカード払い」が79.8%で最も高いポイントを獲得しています。

■インターネットで購入する際の決済方法

出典:総務省「令和3年版 情報通信白書」(2023年6月)

一方で、クレジットカードの不正利用は、近年になって増え続けています。一般社団法人日本クレジット協会が2023年6月に発表した「クレジットカード不正利用被害額の発生状況」では、1997年以降に発覚しているクレジットカード不正利用の被害額が公開されています。

集計結果を見ると、2021年の不正利用被害額は約330億円でしたが、2022年は約437億円となっており、前年を100億円以上、上回っている状況です。

クレジットカード不正利用被害額の内訳を調べてみると、偽造クレジットカードによる被害額が2017年をピークに減少している反面、クレジットカードの番号盗用による被害額が増加傾向にあり、2022年には不正利用の約94%を占めるまでになっています。

こうした数字を見ると「やっぱりクレジットカードは危ない」と感じるかもしれません。確かに、クレジットカードにそうしたリスクが潜んでいることは事実です。しかし、これらの不正利用は、その手口を知り、対策を講じておけば、未然に防ぐことができます。

万一、不正利用されたとしても、早期に発見し対処することで、被害を最小限に抑えることが可能です。

不正利用については、以下の記事で詳しく説明しております。

コロナ禍における不正利用の傾向と、そもそも不正検知サービスとは?

クレジットカードの不正利用でよく使われる手口と予防策

クレジットカードの不正利用を防ぐには、まず不正の内容を知ることです。現在、数多く報告されている不正利用には、以下のようなものが挙げられます。

■クレジットカードを不正利用する手口の例

フィッシング詐欺

フィッシング詐欺とは、金融機関やクレジットカード会社、大手通販サイトなどの名前で偽メールを送り、メール内のリンクから、本物そっくりに作った偽サイトに誘導する詐欺の手口です。その後、クレジットカード番号や暗証番号などの情報を入力させ、入手した情報をもとにクレジットカードを不正に利用します。

偽メールや偽サイトには、「不正と思われるアクセスがありました」「アカウントが利用停止になっています」「クレジットカードの有効期限を更新してください」など、危機感をあおる文章が使われています。

フィッシング詐欺の予防策

フィッシング詐欺の予防策としては、個人情報やクレジットカード番号などの入力を催促するメールやサイトへのリンクが届いたら、すぐに入力するのではなく、本当に問題ないかどうか確認することが挙げられます。フィッシング詐欺の予防策としては、個人情報やクレジットカード番号などの入力を催促するメールやサイトへのリンクが届いたら、すぐに入力するのではなく、本当に問題ないかどうか確認することが挙げられます。クレジットカード会社や金融機関などから送られてくるメールで、利用者のIDやパスワード、クレジットカード番号や暗証番号などを入力するように促すようなことはまずありません。

むやみにメールやSMSに貼られているURLをクリックしないことも大切です。文面に記載されている企業などの公式サイトかどうか、URLを確認したうえで開きましょう。

また、複数のWebサイトおよびオンラインサービスなどで同じIDやパスワードを使っていると、フィッシング詐欺によってIDやパスワードが盗まれた際にほかのサイトにもアクセスされ、不正利用被害に遭ってしまうリスクが高くなります。同じIDやパスワードを使い回さず、Webサイトやサービスごとに別のものを使い分けて、厳重に管理することをおすすめします。

なりすまし

なりすましとは、不正に入手したクレジットカード情報を使い、クレジットカード会員本人になりすますという不正利用の手口です。偽造クレジットカードを作り、実店舗で使われることもあります。

利用日や利用店舗に覚えがない、海外など普段は行かない地域で利用されているといった利用履歴が残ることがあります。

なりすましの予防策

なりすましの予防策としては、オンライン上でクレジットカード決済をする際に、本人認証システムの「3Dセキュア」を導入しているECサイトを利用することが挙げられます。3Dセキュアは、Visa、Mastercard、JCB、American Expressの4ブランドで共通する世界的な本人認証です。3Dセキュアではクレジットカードの利用者自身が任意で決めたパスワードを入力するため、なりすましによる不正利用対策になります。

インターネットショッピング詐欺

インターネットショッピング詐欺とは、架空のショッピングサイトを立ち上げて、商品を販売する詐欺の手口です。代金の搾取が目的なので、クレジットカード決済が行われても商品は発送されません。

Webサイト内の日本語の表現がおかしい、商品価格が相場に比べて極端に安い、会社名や連絡先が架空のものなど、嘘や不自然な部分が見られる場合もあります。

インターネットショッピング詐欺の予防策

こうしたインターネットショッピング詐欺に遭わないためにも、Webサイトなどでクレジットカード情報を入力するときは、安全なサイトであるかどうかをしっかり確認する必要があります。悪質なサイトかどうかを見極める際は、次のようなポイントに着目してみましょう。

・URLに違和感がないか(スペルミスがある、大手企業のURLに似せているなど)

・Webサイト内のテキストに誤字や不自然な日本語がないか

・Webサイト内の表記や内容に公式サイトと異なる部分がないか

・Webサイト内に記載されている会社名や住所などが実在するものかどうか

あやしいサイトかどうか判断に迷ったときはアクセスせず、該当する企業のサポートセンターなどに問い合わせてみると安心です。

スキミング

スキミングは、店頭などでスキャナーを使ってクレジットカードの磁気データを読み取る不正利用の手口です。読み取ったクレジットカード情報を使って、ネットショッピングに悪用したり、偽造クレジットカードを作ったりします。

スポーツジムやサウナなどロッカールームのある場所のほか、ホテルやゴルフ場など人の出入りが多い場所、コンビニのATMなど人目が届きにくい場所などでスキミングされやすいという特徴があります。

スキミングの予防策

スキミングを予防するには、暗証番号の管理を徹底することが第一です。第三者から推測されない番号を設定して、入力するときは他人に覗かれる心配がないか周囲を確認します。会計などを含めて、クレジットカードを第三者に預けないようにしましょう。

可能であれば、クレジットカードは磁気ストライプ式ではなくICチップ搭載のものが望ましいです。ICチップが搭載されたクレジットカードは情報が暗号化されており、スキミング被害に遭いにくいというメリットがあります。また、ATMでクレジットカードを使う際は、監視カメラが設置されているATMなど、スキミング対策がされた場所でのみ使うよう心がけることも大切です。

クレジットカードの盗難や紛失

クレジットカードの盗難や紛失も不正利用につながります。スリ、置き引き、車上荒らしなどの窃盗行為でクレジットカードを盗み出し、不正に利用するという手口です。

イベントや公共交通機関などの人混み、人目の届きにくい広い駐車場などで盗難に遭いやすいという特徴があります。

クレジットカードの盗難や紛失の予防策

クレジットカードの盗難や紛失を予防するためにも、クレジットカードの入った財布は必ず携帯し、常に厳重に管理するようにします。他人から取り出しやすい場所にしまうことも避けましょう。少し席を離れたいだけのときでも、車の中や飲食店などでクレジットカードの入った財布やカバンを放置しないことも大切です。

また、クレジットカードを複数枚所持する方も多いですが、管理しきれないほどの枚数のクレジットカードを持つことでも、紛失や盗難のリスクは高くなるため注意してください。クレジットカードの所有枚数は、紛失や盗難に遭ったらすぐに気づくことができて、利用明細も細かく管理できる分だけにとどめることをおすすめします。

出会い系サイト詐欺

出会い系サイト詐欺とは、特定の出会い系サイトのユーザーを装ってサイトへ誘導し登録させ、クレジットカード決済によってポイントを購入するなどと持ち掛け課金させてカード情報を盗み取るという手口です。

この手口の場合、被害者がみずから出会い系サイトを利用した負い目があることに加えて、詐欺の立証が困難なこともあり、周囲や警察へ相談できず泣き寝入りとなってしまうケースも多いようです。

クレジットカードの不正利用を早期発見するには?

クレジットカードの不正利用は、お客さまだけでなく、店舗を運営するEC事業者さまにも被害をもたらします。ECサイトでこのような不正利用が起こると、経済的な被害はもちろん、店舗の信用が大きく損なわれます。お客さまもEC事業者さまも、先程ご紹介したクレジットカードの不正利用の例を踏まえて対策するとともに、万が一不正利用が発生した場合も、早期に発見できる体制を整えておくことが重要です。

続いては、クレジットカードの不正利用を早期発見する方法についてご説明しましょう。

■クレジットカードの不正利用を早期発見する方法

利用明細を定期的に確認する

不正利用を早期発見するには、クレジットカードの明細を定期的にチェックすることが重要です。クレジットカードの明細は、お客さまの場合は利用明細、EC事業者さまの場合は売上明細や取引明細と呼ばれています。

お客さまであればクレジットカード会社のマイページで確認することができますし、EC事業者さまであれば利用している決済サービスのウェブ上で確認することができます。少々面倒に感じるかもしれませんが、「毎週日曜の夜」など明細を確認する日時を決めて習慣にするといいでしょう。

また、ECサイトでも実店舗でも、実際に買い物をした店の店名と、利用明細に記載されている店名が異なる場合があります。これは、屋号として使っている店名と、決済を受け持つ運用会社名が違うために起こることですが、お客さまからすると不審に思いがちなところです。

日付と利用額を照らし合わせれば確認できますが、EC事業者さまとしてはこうした不安を与えないよう、利用明細に掲載される社名や屋号を、決済画面などで告知しておくことをおすすめします。

家族カードの利用明細も要確認

お客さまの場合は、家族カードの利用にも注意が必要です。家族カードの利用履歴は、本会員のクレジットカードの利用明細にまとめて計上されます。ですから、家族カードを追加発行していると、自分が知らないうちに家族が使ったクレジットカードの利用履歴が残ることになるのです。

家族カードを発行しており、日付にも金額にも心当たりがない履歴が残っているときは、家族カードが使われていないか確かめてみましょう。

クレジットカード会社から不正利用の連絡が来ることも

クレジットカード会社は、24時間365日体制でクレジットカードの利用状況を監視しています。そして、不正が疑われる取り引きを見つけると、確認のためにお客さまやEC事業者さまに電話連絡を入れることがあります。

どのような取り引きが不正と疑われるのかは、ケースバイケースです。例を挙げると、普段は居住地周辺でしかクレジットカードを使っていなかったのに、突然海外で使われた場合や、スーパーやコンビニでの利用がほとんどだったのに、高価なバッグや宝飾品などを購入した場合などがあります。

お客さまが不正利用に気づいた場合の対処法

クレジットカードの不正利用が発覚したら、どのように対処すればいいのでしょうか。まずは、お客さま側が行う対処法からご紹介します。

クレジットカード会社に連絡し、チャージバックを申請する

不正利用に気づいたら、まずクレジットカード会社に連絡をしましょう。対応が早ければ早いほど、被害を小さく抑えることができます。

報告のあった取り引きが不正利用だと判明すると、クレジットカード会社は不正利用された取り引きを取り消す「チャージバック」を行います。

チャージバックについては、下記のコラムをご参照ください。

チャージバックとは?クレジットカード不正利用の対策を解説

クレジットカードの再発行を行う

クレジットカードの不正利用が判明すると、クレジットカード会社はそのクレジットカードを無効にします。これは支払い遅延などによる一時的なものではありませんから、それ以降はそのクレジットカードを使うことができなくなります。そのため、クレジットカードの再発行が必要です。

新たなクレジットカードが手元に届くまでは、当然ながらクレジットカード払いを利用することができません。

警察へ届け出を出す

クレジットカードの紛失・盗難に遭ったり、不正利用に気づいたりしたときは、警察へ遺失届や被害届を提出します。その際に警察から受理番号を受け取ったら、あらためてクレジットカード会社に連絡しましょう。カード会社へ受理番号を伝えると、クレジットカードの再発行と紛失・盗難保険の手続きを進めてくれます。

警察に届け出を行わない、またはカード会社に受理番号を伝えなかった場合、紛失・盗難保険が適用されないことがあるため注意が必要です。

ただし、クレジットカードの不正利用やインターネット上での詐欺被害などは、相手と対面していないために、警察側も対処が難しい点には留意しましょう。

また、クレジットカードを利用したのに商品が届かないといった場合は、消費生活センターに連絡することが推奨されています。

EC事業者さまが不正利用に気づいた場合の対処法

ECサイトなどのEC事業者さまが、クレジットカードの不正利用に気づいた場合も、最初に行うことはクレジットカード会社への連絡です。

しかし、その後の処理については、不正利用が発覚したタイミングが商品の発送前か、発送後かによって違ってきます。それぞれの場合に行う対処法についてご説明します。

商品の発送前に、不正利用が発覚した場合

商品の発送前に不正利用が発覚した場合、まずは商品の発送を保留し、お客さま本人に連絡をとりましょう。

メールだけではなく、電話で直接話をして、実在する人物かどうかを確認します。電話で連絡がとれた場合は本人かどうかを確認し、本人だった場合は支払い方法の変更を行ってください。

お客さま本人と連絡がとれなかった場合は、受注をキャンセルします。決済依頼前であればオーソリの解除を行い、決済依頼後14日以内であれば決済依頼のキャンセルを行います。オーソリとはオーソリゼーションの略で、お客さまのクレジットカードで決済できるかを確認する作業のことです。決算依頼後14日以降は決済依頼をキャンセルできないため、EC事業者さまからお客さまに直接返金が必要です。

クレジットカードの返金については、以下の記事で詳しく説明しております。

クレジットカードの返金とは?返金処理の仕組みと払い戻し方法を解説

すでに商品を発送した後で、不正利用が発覚した場合

商品発送後に不正利用が発覚した場合、発送した商品を取り戻すことは極めて難しくなります。お客さまから申請されたチャージバックが承認されれば、商品代金の回収もできません。商品と、その発送に関わるすべてのコストと手間が、EC事業者さまの損失となってしまいます。

EC事業者さまに必要な不正利用対策

弱い立場にあるお客さまを保護するという点で、チャージバックは優れたシステムです。ただし、EC事業者さまにとっては、クレジットカードの不正利用とそれに伴うチャージバックのリスクに常にさらされることになります。

しかし、クレジットカードには、お客さまだけでなくEC事業者さまを守るためのサービスもあります。これからご説明するサービスを組み合わせることで、不正利用への防御をより強固にし、安全・安心な店舗運営を行うことが可能です。

ASPの不正注文アラートを利用する

ECサイトの構築にASP(アプリケーションサービスプロバイダ)を利用している場合は、ASPに不正注文アラート機能が備わっていることがあります。

これは、過去に行われた不正利用の内容をデータベース化しておき、お客さまの情報や届け先の情報などから、「不正利用が疑われる注文」が入ると注意を促すアラートが出されるというものです。

不正注文であることを断定することはできませんが、EC事業者さまへの注意喚起はできます。お客さまに確認すれば、不正利用かどうかを明らかにできるでしょう。

セキュリティコードを利用する

セキュリティコードとは、一般的にクレジットカードの裏面または表面に記載されている3桁または4桁の数字です。このセキュリティコードはクレジットカードに記録されている磁気情報には含まれていないため、スキミングによって盗まれることがありません。本物のクレジットカードを持っている人だけが、知ることができる情報です。そのため、クレジットカードの不正利用防止には、大いに役立ちます。

ネットショップの注文画面で、セキュリティコードの入力を必須とすれば、不正利用のリスクを下げることができるでしょう。

セキュリティコードについては、以下の記事で詳しく説明しております。

クレジットカードのセキュリティコード(CVV2/CVC2)とは?

3Dセキュアを活用する

3Dセキュア(本人認証サービス)とは、お客さまがクレジットカード会社に登録したパスワードを使い、本人認証を行う仕組みです。ブランドごとに名称は異なりますが、一般的に「3Dセキュア」と呼ばれています。3Dセキュアは、Visaが提供する本人認証サービスの名称です。

このパスワードは、クレジットカード契約者本人しか知りえない情報です。そのため、スキミングなどの手口によってクレジットカード番号や有効期限といった情報を盗まれた場合でも、他人による「なりすまし」を防ぐことができます。

本人確認サービスについては、以下のページで詳しく説明しております。

本人認証サービス | SBペイメントサービス

3Dセキュアについては、以下の記事で詳しく説明しております。

【2025年4月以降原則必須】EMV 3-Dセキュア(3Dセキュア2.0)とは?メリットや決済手順を解説

AI不正検知システムを使う

AI不正検知とは、SBペイメントサービスで運用されている、AI(人工知能)を活用した不正検知システムです。不正利用の大部分を占めるのは、フィッシングやスキミングによるクレジットカード情報の盗用です。一方で、その手口はますます巧妙になり、EC事業者さまが日常業務の中で気づくことは、非常に難しくなってきました。

そこで、SBペイメントサービスでは、不正利用を疑わせるさまざまな要素を決済ごとにスコアリングし、AIで算出・判定するシステムを構築・運用しています。年間数億件にも及ぶ膨大な決済データを検証し、多種多様な不正利用のパターンを学習していくことで、より精度の高い不正検知を可能にしています。

SBペイメントサービスのAI不正検知システムは、フリープラン、スタンダードプラン、アドバンストプランの3つのプランをご用意しており、フリープランであればコストをかけることなく導入可能です。また、各種EC構築パッケージとも連携しており、導入が検討しやすくなっています。ほかの対策と併せて利用することで、EC事業者さまにとって安心できるセーフティネットを構築できるでしょう。

AI不正検知については、以下のページで詳しく説明しております。

AI不正検知 | SBペイメントサービス

不正利用対策については、以下の記事で詳しく説明しております。

SBペイメントサービス、「AI不正検知」でクレマス対策 決済前・中・後に応じた幅広い不正対策提供 | 日本ネット経済新聞

クレジットカード決済を導入するEC事業者が知っておくべき不正利用対策

不正利用対策におすすめのソリューション紹介

不正利用が止まらない場合は、以下のソリューションもご検討ください。

O-PLUX(オープラックス)

O-PLUX(オープラックス)

特徴1:全ての不正注文対策に使える

特徴2:1万円でお試し利用可能

O-PLUXは導入実績NO.1の不正検知サービスです。

ECで起こる不正ログイン・不正注文をリアルタイムに検知し、個人情報漏洩やクレジットカードの不正利用、悪質転売などの不正被害の防止及び審査業務の自動化を実現します。

ほぼ全てのカートと連携可能で、連携方法も豊富なため開発不要で導入することもできます。各ECサイトに合わせた費用・検知条件でご利用可能です。

| 料金 | 月額4,000円~ ※一部プラン | 対応カート | ほぼ全てのカート |

|---|---|---|---|

| 導入実績 | 累計12万サイト以上 | 導入事例 | KEYUCA / サンスター / JINS |

SBペイメントサービスが選ばれる理由

クレジットカードの不正利用は年々巧妙になり、それとともに不正利用の被害総額は膨れ上がるばかりです。

SBペイメントサービスは、クレジットカードの国際的なセキュリティ基準である「PCI DSS(Payment Card Industry Data Security Standard)」に準拠しており、前述したさまざまな不正利用対策のソリューションを提供しています。こうしたことから、おかげさまで多くのEC事業者さまに選んでいただいています。

お客さまとEC事業者さまをクレジットカードの不正利用から守ることは、SBペイメントサービスの使命です。これからも、さまざまな不正利用対策の取り組みを行っていきます。

クレジットカードの不正利用対策を強化したいEC事業者さまは、ぜひ一度お問い合わせください。

セキュリティ・決済オプションサービスについては、以下のページで詳しく説明しております。

セキュリティ・決済オプションサービス | SBペイメントサービス

よくあるご質問

- Q.

- クレジットカードの不正利用の手口を教えてください。

- A.

- 不正利用の主な手口としては、偽メールから偽サイトに誘導してクレジットカード番号や暗証番号を入力させる「フィッシング詐欺」、不正に入手したクレジットカード情報で会員本人になりすます「なりすまし」、架空のECサイトで商品を販売する「インターネットショッピング詐欺」、スキャナーでクレジットカードの磁気データを読み取る「スキミング」などがあります。

- Q.

- クレジットカードが不正利用されたかどうかを確認する方法はありますか?

- A.

- 不正利用を早期発見するには、クレジットカードや家族カードの明細を定期的にチェックすることが重要です。お客さまの場合はクレジットカード会社のマイページや専用アプリから利用明細を、EC事業者さまの場合は利用している決済サービスのWebサイト上で売上明細や取引明細を確認します。

- Q.

- クレジットカードが不正利用されたとき、どう対処すればいいですか?

- A.

- お客さまが不正利用に気づいたときは迅速にクレジットカード会社へ連絡し、不正利用された取り引きを取り消す「チャージバック」の申請と、クレジットカードの再発行の依頼を行います。EC事業者さまが不正利用に気づいた場合も最初にクレジットカード会社へ連絡してください。商品の発送前に不正利用が発覚したときは、商品の発送を保留してお客さまへ連絡し、支払い方法の変更や受注キャンセルを行います。

その他のご不明点はFAQ よくあるご質問をご確認ください。

セキュリティについては、以下の記事で詳しく説明しております。

お役立ち情報 セキュリティ一覧 | SBペイメントサービス