口座振替サービス

定期購入サービスに最適!購入代金回収の効率化を実現

WEB登録とペーパー登録に対応した「口座振替サービス」

口座振替サービスとは

「口座振替サービス」は、利用者さまの金融機関口座を通じた決済手段です。

毎月期日になるとお客さまの口座から自動でご利用料金が引き落としされるため、支払い忘れや遅延といった事業者さまの未回収管理などのリスクが減少し、代金回収の効率化を実現できます。さらに、クレジットカードをお持ちでないお客さまや、ECサイトでクレジットカードの利用に抵抗のあるお客さまにも安心してご利用いただけますので、新たなお客さまの開拓にもつながります。

特長

お客さまのメリット

- お支払いのために、銀行やコンビニなどへ出向く必要がありません。

- 自動引き落としなので、支払い忘れや遅延、請求金額の誤りなどの心配がありません。

- クレジットカードをお持ちでない方も安心してお使いいただけます。

- 自動引き落としなので、支払いに関わる入金手数料はかかりません。

事業者さまのメリット

4つの大きな要素をピックアップいたしました。業務面の流れなど各種ご不明点あればお気軽にお問い合わせください。

-

利用継続率アップ

利用者さまが意識することなく継続的に支払いが行われるため、手間がかからず解約が減少、利用継続率の向上につながります。

-

未払いリスク低減

利用者さまの口座から、期日になると自動で料金が引き落とされるため、遅延や料金未払いなどのリスクが減少します。

-

従量課金対応

支払い金額が変動する従量課金にも対応。利用者さまのご利用・ご購入実績に応じた課金データを連携いただくことで対応可能です。

-

ほぼすべての金融機関に対応

ゆうちょ銀行やネット銀行はもちろん、都市銀行、全国地方銀行など、ほぼすべての金融機関口座からの引き落としに対応しています。

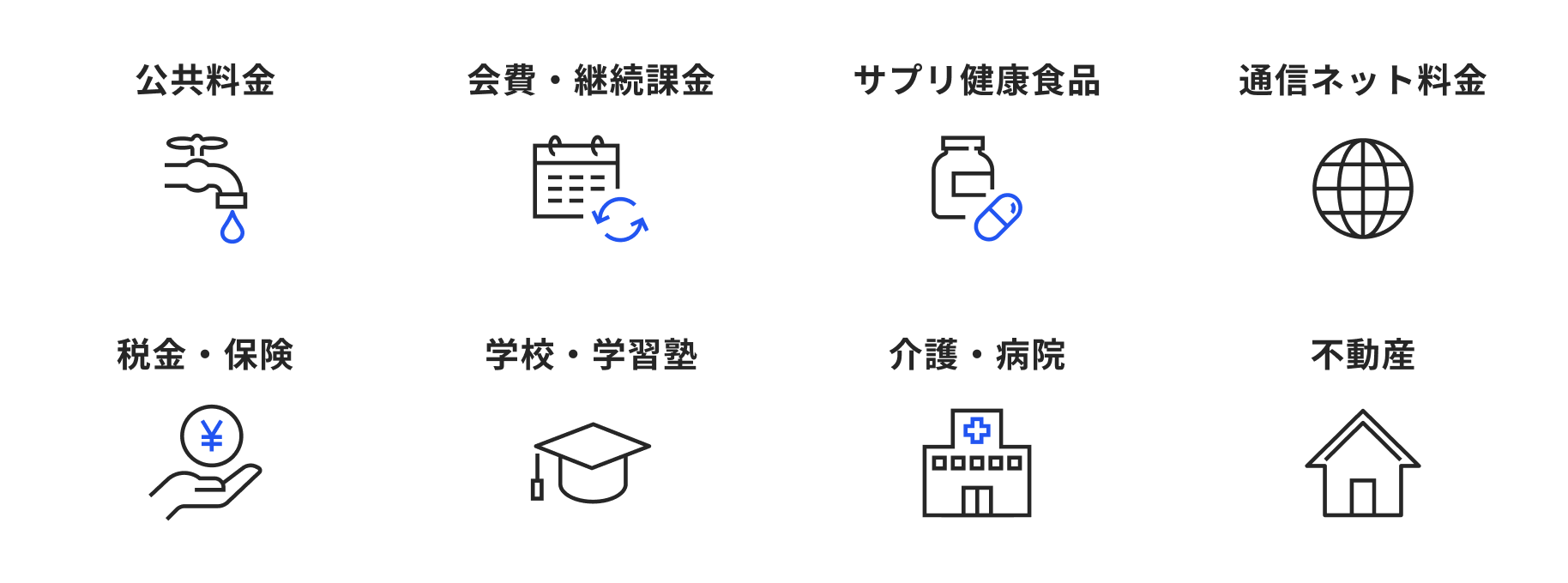

こんな業種におすすめ

口座振替は、幅広いサービスでお客さまに利用されています。例えば、コンビニでいつも繰り返していた公共料金へのお支払いや毎月固定でのお支払いが発生する不動産などに対して非常に利便性の高いサービスとなっております。

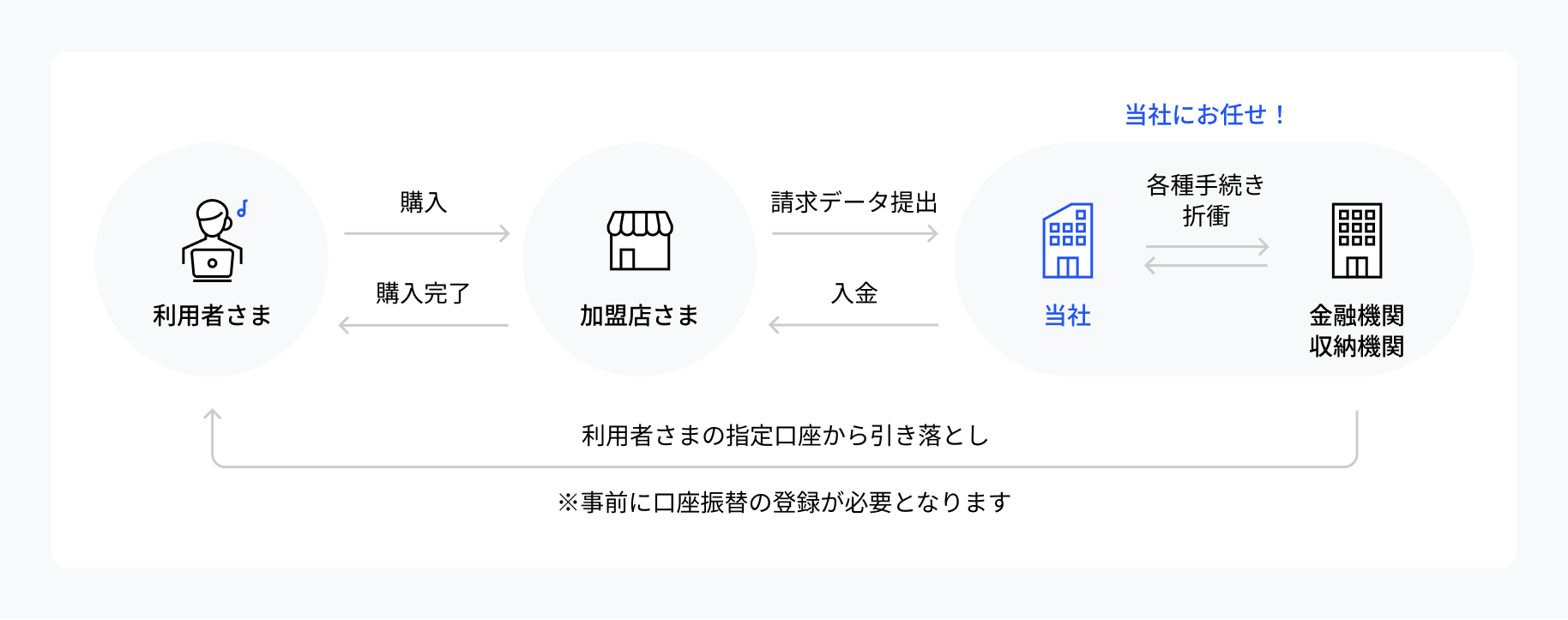

口座振替サービスの仕組みや流れ

「口座振替サービス」は、利用者さまが指定した金融機関口座からご利用料金を引き落とします。

口座振替サービスの登録方法

「WEB登録」と「ペーパー登録」の2種類をご用意しています。

事業者さまはニーズに合わせて、ご導入いただけます。

-

WEB登録

WEBで登録が完了し、用紙への記入などが不要の利便性の高いサービスです。WEB上で完結するペーパーレスの登録方法のため、事業者さまの運用の手間もはぶけます。

-

ペーパー登録

WEB上での手続きが不安なお客さまには、ペーパー登録がおすすめです。専用用紙に必要情報をご記入、ご捺印いただくことで登録が可能です。

WEB登録の方法は口座振替サービス(WEB登録)ご利用イメージをご確認ください

導入方法

お申し込みからご利用開始までのお手続きに関しては下記のフローとなります。

詳細な導入手順と費用は導入と料金についてをご確認ください。

-

事業者さま お問い合わせ

-

当社(SBPS) ヒアリング・お見積り提示

-

事業者さま お申し込み

-

当社(SBPS) 審査

-

当社(SBPS) システム構築

-

事業者さま システム接続/ご利用開始

またご利用料金(手数料など)は詳細をお伺いしたうえでお見積りいたしますので、下記のお問い合わせボタンよりお問い合わせください。

提供機能

| 課金方式 | 口座振替登録 | 口座振替 | 清算 |

|---|---|---|---|

| 継続課金 (継続振替) |

WEB登録:リンク型 ペーパー登録:管理画面 |

ファイルAPI※ | 月末締め 翌月末支払 |

| 課金方式 | 継続課金 (継続振替) |

口座振替登録 | WEB登録:リンク型 ペーパー登録:管理画面 |

口座振替 | ファイルAPI※ | 清算 | 月末締め 翌月末支払 |

|---|

- ファイルのアップロード / ダウンロードを行うAPIです。

- 接続方式の概要、手順もあわせてご確認ください。

技術者向け(接続方式)

[注]

返金機能はございません。

決済導入をご検討の方は

お気軽にお問い合わせください

各種サービスに関する詳しい資料ダウンロードから、費用や導入に関するご相談はお問い合わせより承ります。

SBペイメントサービスがお届けする

おすすめコンテンツ

口座振替決済サービスをご利用いただいておりますお客さまから多くいただいた質問内容となっております。

導入をご検討のお客さま、ご利用中のお客さまでも接続方式や費用、使用用途などの詳細ページもございますのでお気軽にご覧ください。