キャリア決済とは何ですか?

キャリア決済とは、各キャリアのID/パスワード認証を利用して、携帯電話料金と合算で商品などの代金を支払うことができる決済サービスです。

簡単操作でお支払いいただけるため、スマートフォンで決済を行うお客さまの利便性向上が見込めます。

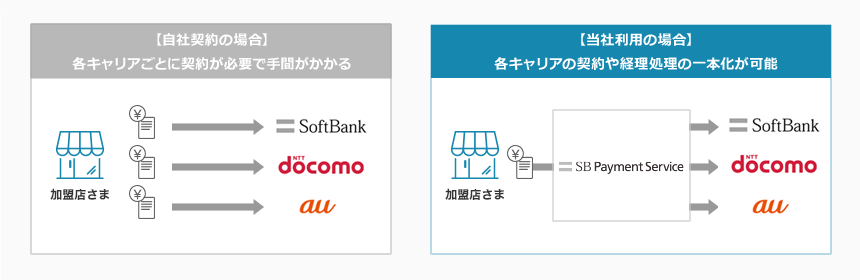

加盟店さまが自社で各キャリアと契約を行う場合、お申し込みや経理処理など各キャリアごとに発生しますが、当社を利用し契約されることで、すべて一本化することが可能です。

また当社なら「ソフトバンクまとめて支払い」、「d払い」、「au PAY(auかんたん決済)」の3キャリアの決済をまとめてご導入いただけます。

- ソフトバンクまとめて支払いをご導入いただくと、ワイモバイルのお客さまにも「ワイモバイルまとめて支払い」としてご利用いただけます。

4つのメリット

1.販売機会の拡大

クレジットカードが無くても使える決済手段

キャリア決済は、クレジットカードを持たない若年層のお客さまや、Web上でのカード情報入力を好まないお客さまにもご利用いただけて、近年利用が拡大しています。

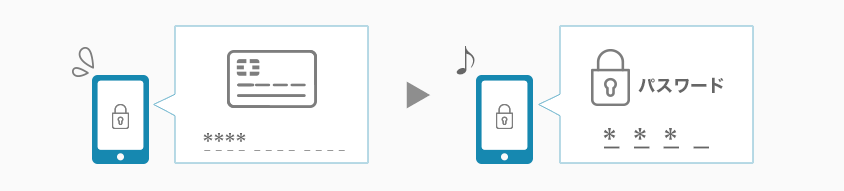

簡単な操作でカート離脱を抑制

キャリア決済はクレジットカード決済のように長いカード番号を入力せずに、各キャリアに事前登録している4桁の暗証番号を入力するだけで決済が完了します。そのため、小さい画面のスマートフォンや電車などの移動時間でも簡単な操作で決済ができ、カート離脱の抑制も見込めます。

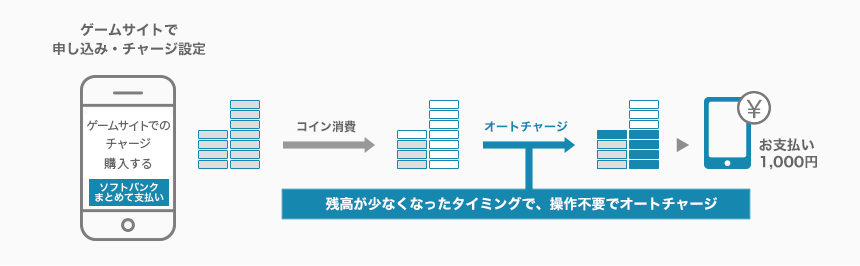

2.3キャリアの継続課金に対応

サービスにあわせて課金日や金額を選択可能

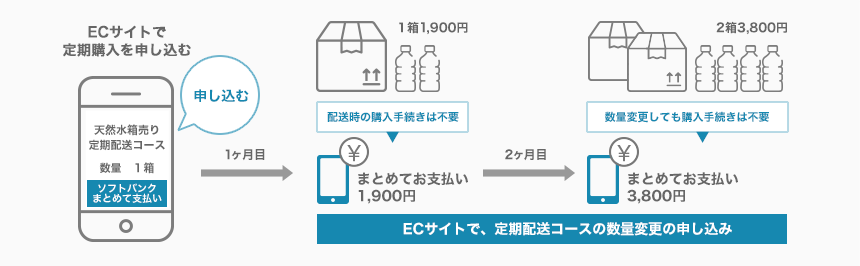

当社のキャリア決済は3キャリアの継続課金にも対応しております。

定期配送・頒布会、デジタルコンテンツ配信サービス、会費、購読料、視聴料などの、継続的な課金ができるサービスです。

課金タイミングや金額を事業者さまにて設定いただけるため、サービスの特性に合わせて柔軟にご利用いただくことが可能です。

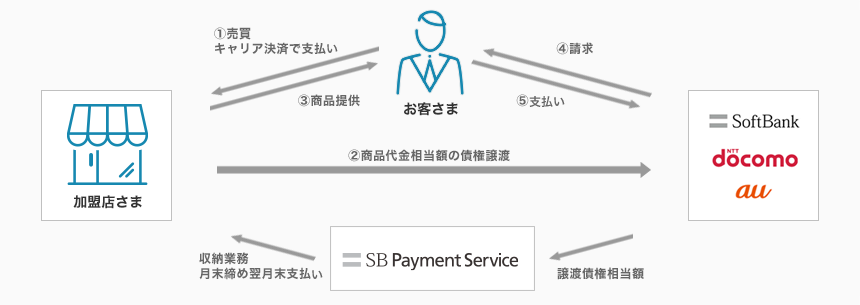

3.未回収リスクなしの安心決済

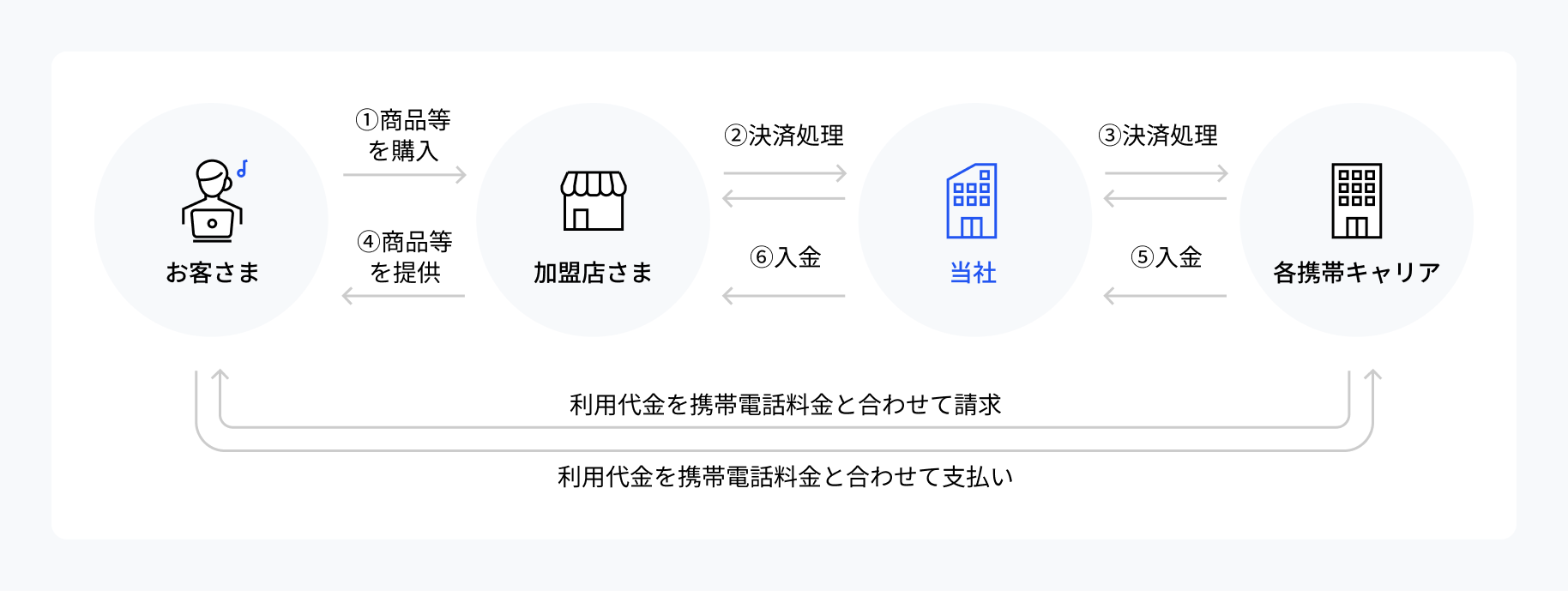

正常に決済処理が完了した取引については、各キャリアが商品代金の債権を譲り受け、携帯電話料金と合算でお客さまに請求します。

各キャリアに譲渡された分の代金は、当社からまとめて事業者さまへ入金いたします。

事業者さまはお客さまの未払いによる未回収リスクを負うことなく、安心してキャリア決済をご導入いただくことができます。

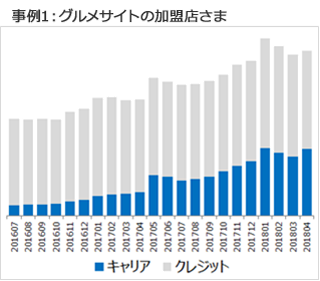

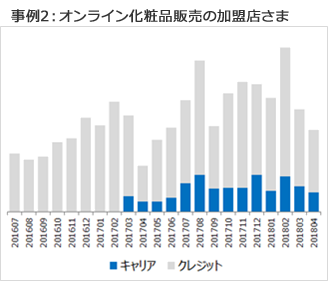

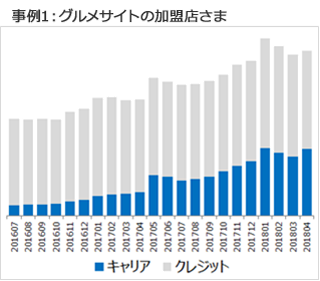

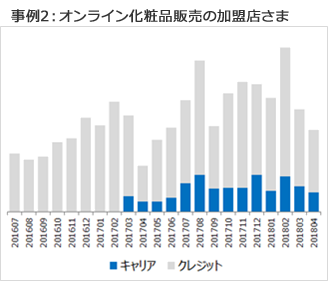

4.追加決済手段としても有効

既にクレジットカード決済を導入されている加盟店さまでも、キャリア決済追加導入後さらに売上が拡大した事例があります。決済手段を追加することで、利用する顧客層も広がり、事業者さまの売上拡大にも繋がります。

集計期間:2016年7月~2018年4月 当社実績調べ

キャリア決済の仕組み

キャリア決済のメリットは、各キャリア決済をまとめて管理できることにあります。

提供機能

ソフトバンクまとめて支払い

ソフトバンクまとめて支払いとは、ソフトバンクが提供する決済手段です。ソフトバンクに登録した通話料の支払情報を利用して、商品等の代金支払いを行うことができます。

お客さまは以下の支払方法をご利用できます。

電話料金合算払い

月々の携帯電話料金の支払方法として口座振替、窓口払いを指定されている場合に、携帯電話料金と合わせて支払う方法

クレジットカード払い

月々の携帯電話料金の支払方法としてクレジットカードを指定されている場合に、登録されているクレジットカードで支払う方法※携帯電話料金とは合算されません

| 接続方式 | |

|---|---|

| リンク型 | API型 |

| ○ | ○※ |

| 課金方式 | ||

|---|---|---|

| 都度 | 継続(簡易) | 継続(定・従) |

| ○ | - | ○ |

| 導入可能サイト | ||

|---|---|---|

| PC | スマートフォン | 携帯 |

| ○ | ○ | - |

| 接続方式 | リンク型 | ○ | API型 | ○※ |

|---|

| 課金方式 | 都度 | ○ | 継続(簡易) | - | 継続(定・従) | ○ |

|---|

| 導入可能サイト | PC | ○ | スマートフォン | ○ | 携帯 | - |

|---|

- 購入処理後の売上確定、取消、返金などの後続処理をAPI型で利用可能です。

d払い

d払いとは、ドコモが提供する決済手段です。ドコモ回線契約者はドコモに登録した通話料の支払情報を利用して、商品等の代金支払いを行うことができます。また回線契約をお持ちでなくてもdアカウントの利用者はd払い(ウォレット)でのお支払いが可能です。

お客さまは以下の支払方法をご利用できます。

電話料金合算払い

月々の携帯電話料金と合わせて支払う方法

d払い残高からの支払い

銀行口座やATMからチャージしたd払い残高から支払う方法

クレジットカード払い ※d払い(ウォレット)対象

事前に設定したクレジットカードから支払う方法

| 接続方式 | |

|---|---|

| リンク型 | API型 |

| ○ | ○※ |

| 課金方式 | ||

|---|---|---|

| 都度 | 継続(簡易) | 継続(定・従) |

| ○ | ○ | ○ |

| 導入可能サイト | ||

|---|---|---|

| PC | スマートフォン | 携帯 |

| ○ | ○ | ○ |

| 接続方式 | リンク型 | ○ | API型 | ○※ |

|---|

| 課金方式 | 都度 | ○ | 継続(簡易) | ○ | 継続(定・従) | ○ |

|---|

| 導入可能サイト | PC | ○ | スマートフォン | ○ | 携帯 | ○ |

|---|

- 購入処理後の売上確定、取消、返金などの後続処理をAPI型で利用可能です。

au PAY(auかんたん決済)

au PAY(auかんたん決済)とは、KDDIが提供する決済手段です。auに登録した通話料の支払情報を利用して、商品等の代金支払いを行うことができます。

お客さまは以下の支払方法をご利用できます。

通信料金合算支払い

月々の携帯電話料金と合わせて支払う方法

au PAYプリペイドカード払い

事前に登録しているau PAYプリペイドカードで支払う方法

au PAYクレジットカード払い

事前に登録しているau PAYクレジットカードで支払う方法

| 接続方式 | |

|---|---|

| リンク型 | API型 |

| ○ | ○※ |

| 課金方式 | ||

|---|---|---|

| 都度 | 継続(簡易) | 継続(定・従) |

| ○ | ○ | ○ |

| 導入可能サイト | ||

|---|---|---|

| PC | スマートフォン | 携帯 |

| ○ | ○ | - |

| 接続方式 | リンク型 | ○ | API型 | ○※ |

|---|

| 課金方式 | 都度 | ○ | 継続(簡易) | ○ | 継続(定・従) | ○ |

|---|

| 導入可能サイト | PC | ○ | スマートフォン | ○ | 携帯 | - |

|---|

- 購入処理後の売上確定、取消、返金などの後続処理をAPI型で利用可能です。

決済可能金額・対応商材

| お客さまの決済可能上限額(月間)※1 | |

|---|---|

| ソフトバンクまとめて支払い | 10万円 |

| d払い | 5万円 |

| au PAY(auかんたん決済) | 5万円 |

| 対応商材 | |

|---|---|

| ソフトバンクまとめて支払い | 物販・デジタルコンテツ※2・役務 |

| d払い | 物販・デジタルコンテツ・役務 |

| au PAY(auかんたん決済) | 物販・デジタルコンテツ・役務 |

| お客さまの決済可能上限額(月間)※1 | ソフトバンクまとめて支払い | 10万円 |

|---|---|---|

| d払い | 5万円 | |

| au PAY(auかんたん決済) | 5万円 |

| 対応商材 | ソフトバンクまとめて支払い | 物販・デジタルコンテツ※2・役務 |

|---|---|---|

| d払い | 物販・デジタルコンテツ・役務 | |

| au PAY(auかんたん決済) | 物販・デジタルコンテツ・役務 |

- 1 お客さまの年齢や携帯電話のご利用状況などによって異なる場合がございます。

- 2 デジタルコンテンツのサイトにソフトバンクまとめて支払いをご導入いただく場合、マルチデバイス対応しているサイトである必要がございます。

スマートフォン対応のみのデジタルコンテンツサイトにご導入されたい場合は、ソフトバンク株式会社との直接契約による決済手段をご案内いたします。

導入方法

お申し込みからご利用開始までのお手続きに関しては下記のフローとなります。

詳細な導入手順と費用は導入と料金についてをご確認ください。

-

事業者さま お問い合わせ

-

当社(SBPS) ヒアリング・お見積り提示

-

事業者さま お申し込み

-

当社(SBPS) 審査

-

当社(SBPS) システム構築

-

事業者さま システム接続/ご利用開始

またご利用料金(手数料など)は詳細をお伺いしたうえでお見積りいたしますので、下記のお問い合わせボタンよりお問い合わせください。

決済導入をご検討の方は

お気軽にお問い合わせください

各種サービスに関する詳しい資料ダウンロードから、費用や導入に関するご相談はお問い合わせより承ります。

SBペイメントサービスがお届けする

おすすめコンテンツ

キャリア決済をご利用いただいております

お客さまから多くいただいた質問内容となっております。

導入をご検討のお客さま、ご利用中のお客さまでも接続方式や費用、

使用用途などの詳細ページもございますのでお気軽にご覧ください。