PayPay(オンライン決済)

6,900万人以上のユーザーを保有※1

簡単で、安全なPayPay(オンライン決済)をご導入できます

※1:2025年5月時点

※動画はイメージです。

PayPay(オンライン決済)とは

PayPayはソフトバンクグループ社とソフトバンク社、ならびにヤフー社の3社が共同出資する、PayPay社のスマートフォン決済サービスです。2018年10月にサービスを開始してから累計登録者数が6,900万人(※1)、加盟店数が410万カ所(※2)をそれぞれ突破しました。

PayPay(オンライン決済)ではPayPayアカウントで簡単に買物ができます。支払い時は銀行口座、ソフトバンクまとめて支払いなどPayPay社が定める方法でチャージしたPayPay残高から選択ができ、クレジットカードを持っていないユーザー層の利用も見込めます。また、 個人情報を加盟店が取得する必要がないため、安心・安全に決済を利用できます。

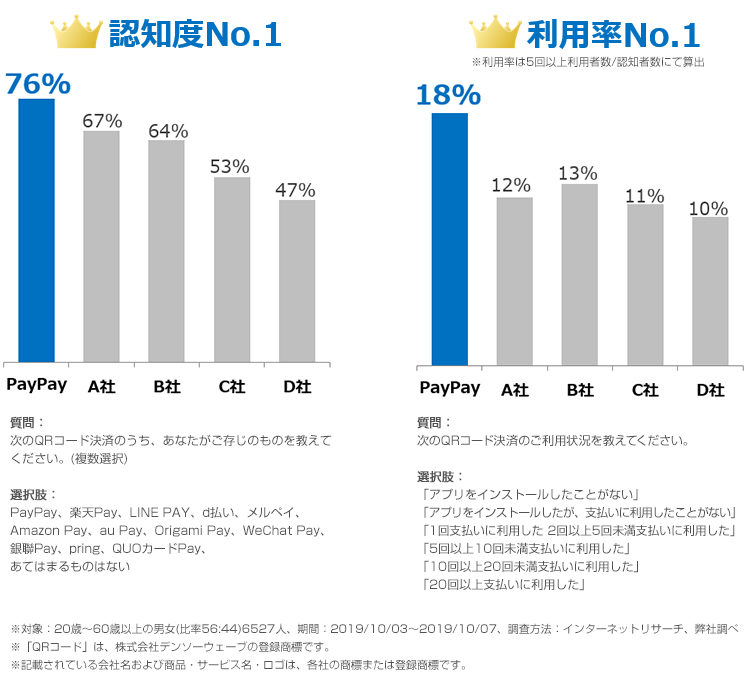

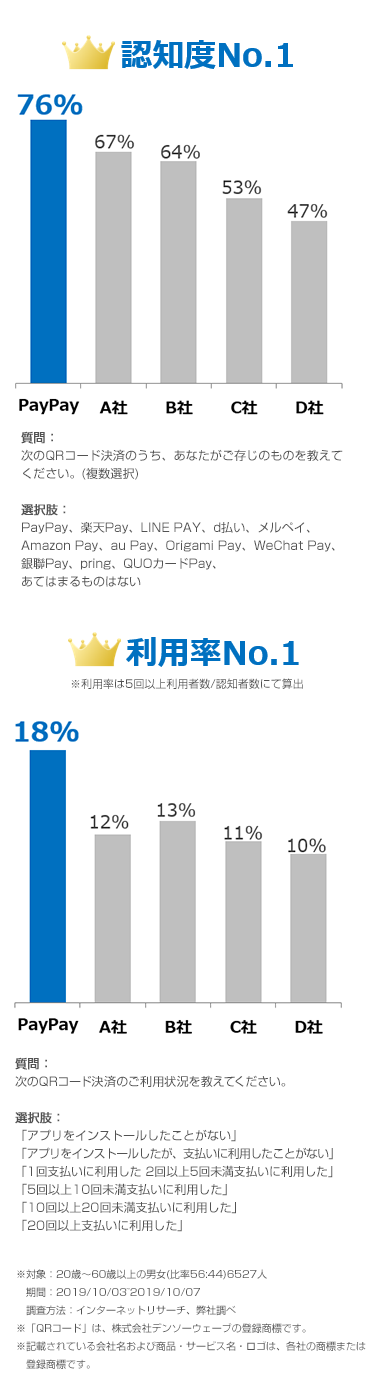

PayPayの認知度はQRコード決済の中で一番高く、普段利用する人の割合も高いです(下図参照)。そのため、これらのPayPay利用者がPayPay(オンライン決済)導入のECサイトを好んで、買い物をすることが見込め、集客効果にも繋がります。

※1:2025年5月時点

※2:2023年3月時点

PayPayの特長

ヤフーとソフトバンクの会員資産活用による利用ユーザー増加

Softbank契約者とYahoo!会員の5,000万人規模の顧客とのリレーションを活用し、PayPay社はPayPay利用者数を増加させます。

ユーザーへの得なキャンペーン提供による集客力UP

他には真似できない規模のユーザーへのキャンペーン施策とヤフーとソフトバンクのユーザーキャンペーンをPayPayに集約することにより、PayPay導入店への集客UPが図れます。

面倒な入力削減し、カゴ落ち防止

PayPayアカウントで簡単に買物ができるため、情報入力の手間を削減し、お客さまのかご落ちを防止します。それにより事業者さまは売上アップが見込めます。

PayPayの購入から入金までの流れ

お客さまは、支払い方法でPayPayを選択し、ログインするだけで、PayPay残高を使って、ECサイトで決済することができます。面倒な情報の入力は不要で、かご落ちを防ぎます。

PayPayの提供機能

| 接続方式 | |

|---|---|

| リンク型 | API型 |

| ○ | - |

| 課金方式 | ||

|---|---|---|

| 都度 | 継続(簡易) | 継続(定・従) |

| ○ | - | ○ |

| 売上方式 | |

|---|---|

| 自動 | 指定 |

| ○ | ○ |

| 導入可能サイト | ||

|---|---|---|

| PC | スマートフォン | 携帯 |

| ○ | ○ | - |

| 接続方式 | リンク型 | ○ | API型 | - | |

|---|---|---|---|---|---|

| 課金方式 | 都度 | ○ | 継続(簡易) | - | 継続(定・従) | ○ | ||

|---|---|---|---|---|---|---|---|---|

| 売上方式 | 自動 | ○ | 指定 | ○ | |

|---|---|---|---|---|---|

| 導入可能サイト | PC | ○ | スマートフォン | ○ | 携帯 | - | ||

|---|---|---|---|---|---|---|---|---|

PayPayの決済可能金額

| 支払方法 | 過去24時間 | 過去30日間 |

|---|---|---|

| PayPay残高 | 50万円 | 200万円 |

| 支払方法 | PayPay残高 | 過去24時間 | 50万円 | 過去30日間 | 200万円 |

|---|

- 2020/1/31時点の情報

- 下限は1円、上限は上記通り

導入方法

お申し込みからご利用開始までのお手続きに関しては下記のフローとなります。

詳細な導入手順と費用は導入と料金についてをご確認ください。

-

事業者さま お問い合わせ

-

当社(SBPS) ヒアリング・お見積り提示

-

事業者さま お申し込み

-

当社(SBPS) 審査

-

当社(SBPS) システム構築

-

事業者さま システム接続/ご利用開始

またご利用料金(手数料など)は詳細をお伺いしたうえでお見積りいたしますので、下記のお問い合わせボタンよりお問い合わせください。

決済導入をご検討の方は

お気軽にお問い合わせください

各種サービスに関する詳しい資料ダウンロードから、費用や導入に関するご相談はお問い合わせより承ります。

SBペイメントサービスがお届けする

おすすめコンテンツ