永久トークン非保持化サービス(専用タブレット端末)

永久トークン非保持化サービス(専用タブレット端末)とは

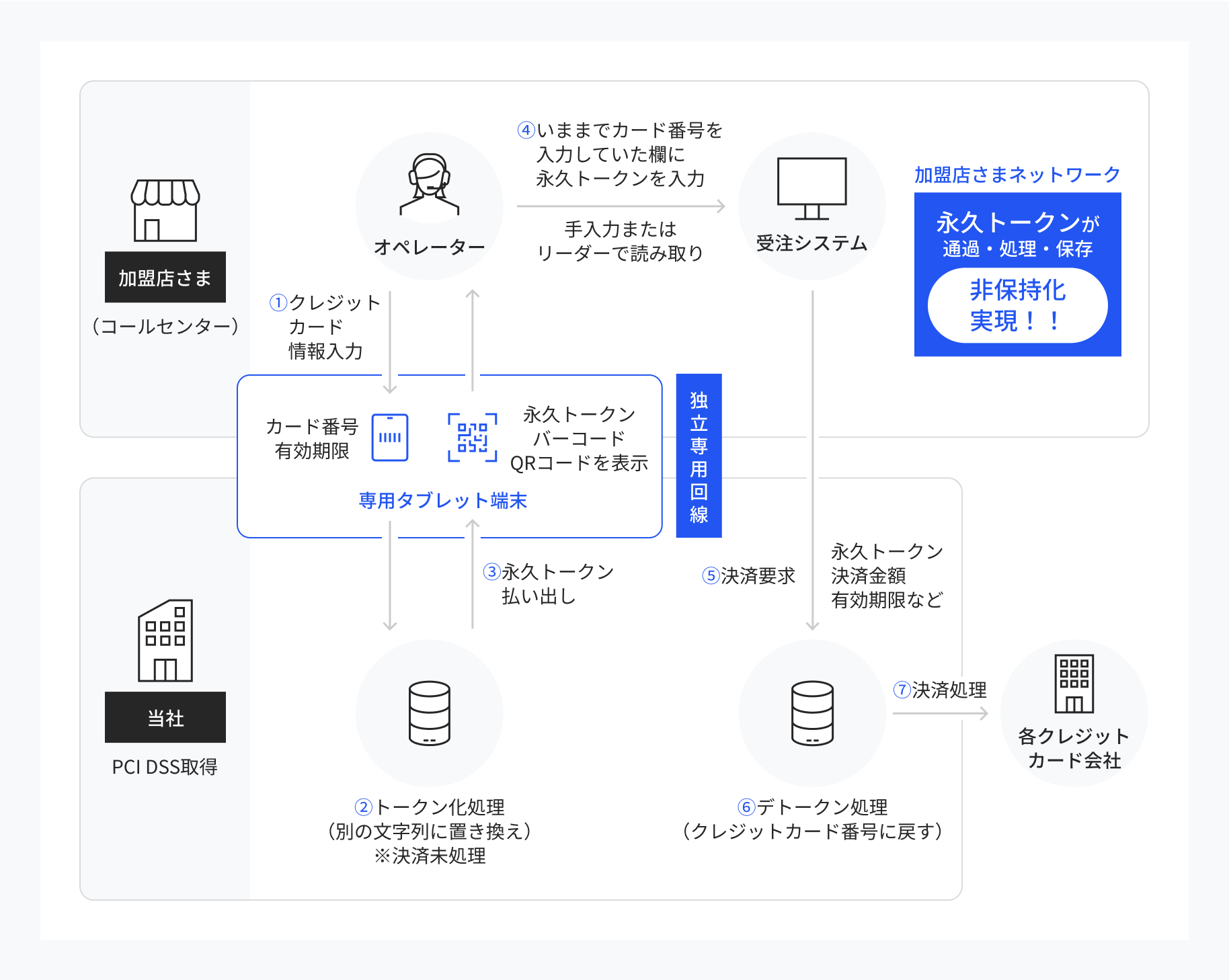

- クレジットカード番号などを別の文字列(トークン)に置き換え、保存・利用する技術です。クレジットカード番号管理資格(PCI DSS)の審査範囲の縮小などに応用されています。

永久トークン非保持化サービスの特長

| クレジットカード情報非保持化 |

|---|

|

【対応コスト大幅削減】 クレジットカード番号と同じ桁数の文字列でトークン化されるため、事業者さまの受注システムを大きく改修することなく非保持化を実現できます。 |

| 継続課金も実現可能 |

|---|

|

【定期購入・保険にも最適】 クレジットカード番号と「永久トークン」の関係は原則一意なので、「永久トークン」を利用して継続課金もご利用可能です。 |

| オペレーション変更範囲の縮小 |

|---|

|

【最小限の運用変更】 「永久トークン」と一緒にQRコードとバーコードも表示されます。リーダー※で読み取れば事業者さまのシステムに瞬時に入力され、他の非保持化サービスと比べオペレーション変更範囲は最小で済みます。 |

| セキュアな環境を実現 |

|---|

|

【情報漏えいリスクを抑制】 「永久トークン」は、元のクレジットカード番号への再変換ができないため、万が一、情報漏えいが発生しても不正利用リスクの心配がありません。 |

このような事業者さまにおすすめ

| コールセンターで注文を受けている |

|---|

|

電話注文の際に、クレジットカード情報を専用タブレットに入力し、「永久トークン」で決済しますので、事業者さまの環境にクレジットカード情報が通過・処理・保存することがなく、非保持化を実現できます。 |

| はがき・FAXで注文を受け付けている |

|---|

|

クレジットカード番号が記入されたはがきやFAXなどでご注文を受け付けている事業者さまのご導入も可能。カタログで集客を行っている事業者さまのクレジットカード情報非保持化対策にも最適です。 |

| 入力業務をアウトソーシングしている |

|---|

|

委託先のBPO事業者さまが専用タブレット端末にカード情報を入力することで非保持化が実現できます。BPO事業者さまと当社が直接データ連携し「永久トークン」に一括変換※することで、大量データの受け渡しも可能になります。 |

永久トークン非保持化サービスのながれ

決済導入をご検討の方は

お気軽にお問い合わせください

各種サービスに関する詳しい資料ダウンロードから、費用や導入に関するご相談はお問い合わせより承ります。

SBペイメントサービスがお届けする

おすすめコンテンツ