カード情報非保持化ソリューション

サービス概要

現在のご契約をそのままご利用可能

(SBペイメントサービスのトークン決済をご利用いただけます)

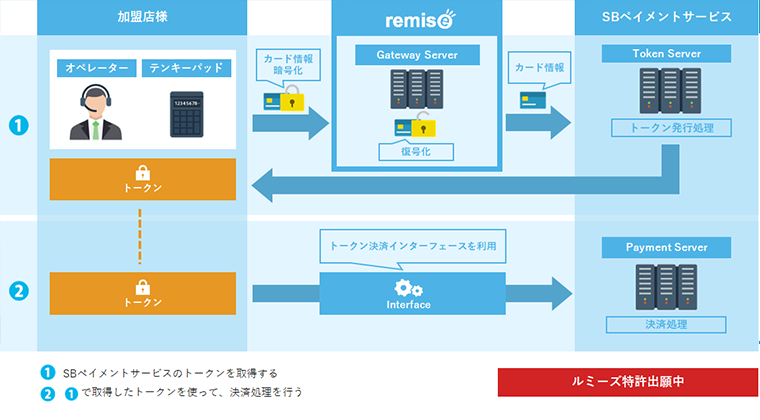

電話・FAX・ハガキ等で受け付けたカード情報は、カード情報の入力に特化したテンキーパッドSREDKeyで入力いただきます。

入力されたクレジットカード情報はSREDKey内で暗号化され、アプリケーション・伝送経路上で一切復号化されることなく、セキュアにルミーズ決済センターまで送信されます。

ルミーズ決済センターでは、暗号化されたカード情報を復号化し、SBペイメントサービスのトークンサーバーに送信します。

SBペイメントサービスのトークンサーバーからトークンを取得しだい、これを加盟店様に引き渡します。(下図①)

加盟店様は、取得したトークンと合わせ、決済情報をSBペイメントサービスの決済サーバーに送信することで決済処理を行います。(下図②)

事業者様は本ソリューションを導入することで、既存システムフローに大きな変更を施すことなく、クレジットカード情報の非保持化に対応することが可能となります。

特徴①クレジットカード情報の入力に特化したテンキーパッドを採用

クレジットカード情報の入力に特化したテンキーパッドSREDKeyをご提供いたします。

このSREDKeyはPCI PTS(※1)のセキュリティ要件SRED(※2)を満たした製品です。入力されたクレジットカード情報はSREDKey内で暗号化され、アプリケーション、伝送経路上で一切復号化されることなく、セキュアにルミーズ決済センターまで送信されます。

- 1 PCI SSCによって策定されたPIN入力を行う決済端末に求められるセキュリティ基準

- 2 決済端末で読み取ったクレジットカード情報を端末内ですぐさま暗号化するといったPCI PTSに含まれるセキュリティ要件

特徴②内回りでの接続

ルミーズ決済センターとの接続は事業者様の既存設備を利用することができます。

インターネット回線のみあれば、新たに回線を準備する必要はございません。運用コストを抑えることができます。

特徴③PCI P2PE認定ソリューション

本ソリューションは、PCI SSC※の定めたPCI P2PEソリューションとして認定されています。

- PCI Security Standards Councilは、American Express、Discover、JCB、MasterCard、Visaによって設立した、クレジットカード業界におけるセキュリティ基準の策定、管理、教育、認知を行うグローバル団体

提供企業