業界トップの大企業が選ぶ、

確かな決済パートナー

豊富な導入実績と安定した決済基盤で、大企業さまの信頼と売上アップに貢献します

導入企業様

こんな課題はありませんか?

-

ビジネスモデルを実現する決済の仕組みが分からない

-

不正利用の被害が増加している

-

決済が原因でカゴ落ちしている

-

決済が集中しても安定稼働させたい

SBペイメントサービスにお任せください

決済でビジネスモデルの実現

をご支援

豊富な導入実績と幅広い提携サービスを生かしたご提案

スマホを活用した決済、プラットフォームへの導入、オンラインとオフラインの融合など、

御社の叶えたいビジネスモデルを実現する決済の仕組みをご提案します。

当社独自の不正対策で

不正被害を抑制

決済サービスと合わせてAI不正検知の

導入が可能

AI不正検知は当社保有の膨大な数の決済データを使い独自で開発・提供する不正検知サービスです。0円からコストを抑えて簡単に導入でき、当社提供の決済画面を利用すれば、システム構築は不要ですぐに利用できます。

|

一般的な |

AI不正検知 |

|

|---|---|---|

|

利用する |

購入者の入力情報 画面の遷移情報 |

当社保有の決済データ |

|

導入時の |

情報取得のための開発 個人情報取得のための |

特になし ※事業者さま独自の決済画面を利用の場合は、専用JavaScriptを決済画面に設置 |

|

コスト |

月額費用 初期費用 トランザクション費用 |

月額費用 |

EMV 3-Dセキュアとの併用で更なるセキュリティ向上

導入が義務化されたEMV 3-Dセキュアと当社独自のAI不正検知を併用することで、チャージバックを回避できるだけではなくWebサイトごとの不正利用傾向に応じた独自ルールを設定でき、さらなるセキュリティの向上が可能です。

決済でカゴ落ちを抑制

多様なニーズに応じた豊富な決済手段

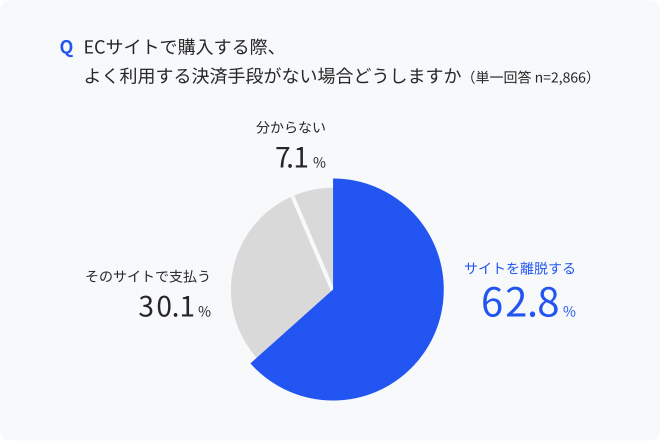

よく利用する決済手段がない場合、過半数の人がそのサイトでは購入せず離脱するという調査結果がでています。※

また現在は決済ニーズも多様化しているため、豊富な決済手段の導入がカゴ落ち防止に繋がります。当社では40ブランド以上の決済をご用意しておりますので、自社のユーザー層に合った決済手段をお選びいただけます。

※2024年3月 通販サイトの利用経験者2,866名を対象に行ったアンケート結果より

決済におけるユーザー体験を向上

シンプルで様々なデバイスに対応した決済画面のため、カゴ落ちを抑制し、売上に貢献します。また、API組み込みにより事業者さまの独自UIでの構築も可能です。

安定かつ強固な

決済基盤を提供

アクセス集中時も安定した決済処理を実行

年間5兆円を超える大規模な決済量を処理する高度な決済システムをご提供しております。

そのため、突発的な大量アクセスにも耐えられ、売上の機会損失を軽減します。

決済導入をご検討の方は

お気軽にお問い合わせください

各種サービスに関する詳しい資料ダウンロードから、費用や導入に関するご相談はお問い合わせより承ります。

企業成長を支える

幅広いサービス内容

-

ソフトバンクグループのサービスを利用し効果的なマーケティング

Yahoo・LINE・PayPayの広告やキャンペーンを生かし圧倒的なユーザー数へリーチが可能。売上拡大に繋がるソフトバンクグループのサービスをご紹介します。

-

海外の顧客拡大で売り上げアップ

Paypal・Alipay+・WeChat Payなど海外顧客向けの決済を導入可能。またWebサイトの多言語化や翻訳には、WorldShopping BIZやWOVN.ioといった提携サービスをご紹介します

-

満足度の高いサポート体制

アフターサービスのサポートを評価するHDI格付けベンチマークの「クオリティ格付け」で最高ランクの三つ星を獲得しているカスタマーサポートのスタッフで、契約~導入後までしっかりと御社をサポートいたします。

導入の流れ

-

事業者さま お問い合わせ

法人名、連絡先、導入希望の決済手段(クレジットカード決済、コンビニ決済など)などをフォームに入力いただきます。

-

当社(SBPS) ヒアリング・お見積り提示

審査・お見積・課金/売上方式・開発要件などに必要な導入予定サービスの情報をヒアリングし、ご要望に沿ってお見積りを作成いたします。

-

事業者さま お申し込み

お申込みフォームに必要情報の入力および必要書類のアップロードいただきます。

-

当社(SBPS) 審査

ご利用になる決済手段について、一括での審査が可能です。ただし、審査内容は決済機関によって異なります。

-

当社(SBPS) システム構築

当社にて事業者さま専用の決済システムを構築しご提供いたします。構築期間は決済手段や設定情報により、数日~2週間程度かかります。

なお、当社では「共用試験環境」を用意しているため、事業者さま専用の決済システムが構築されるまでに、「共用試験環境」にて接続開発を先に行えます。 -

事業者さま システム接続/ご利用開始

事業者さまのサイトと事業者さま専用の決済システムを接続するために、開発を行っていただきます。開発言語としましては、HTTP GET/POSTの送受信ができるものであれば、原則可能となります。システム接続が完了後、ご導入の決済手段にてお支払いを受けつけられるようになります。

決済導入をご検討の方は

お気軽にお問い合わせください

各種サービスに関する詳しい資料ダウンロードから、費用や導入に関するご相談はお問い合わせより承ります。