AI fraud detection

Fraud protection to protect your website

Easy installation using payment data

introduction

Companies

Value provided by AI fraud detection

-

Introduction/Cost

lighten the loadServices independently developed and provided by the Company. It can be easily introduced from 0 yen using the payment data held by our company.

-

Unauthorized use of your company

Grasp trendsYou can check detailed information for each payment from the management screen, and it is possible to understand and analyze fraudulent usage trends.

-

Lost purchase opportunity

suppressIt also supports resale measures. Avoid the risk of trouble and reputational damage such as people who want to buy can not buy.

*When using the Advanced Plan -

further

Security

improvement ofAutomatically blocked by rule judgment settings. When used in conjunction with EMV 3-D Secure, it is possible to take measures according to the fraudulent usage trends of each website.

*When using Standard Plan/Advanced Plan

Reduce introduction and cost burden

Fraud detection service developed and provided by our company.

Using our own payment data, you can easily introduce it from 0 yen at a low cost. If you use the payment screen provided by our company, you can use it immediately without building a system.

With the reliability and track record of handling a large amount of payment data exceeding 5 trillion yen annually, including payments of SoftBank group companies, you can introduce AI fraud detection with peace of mind.

| General fraud detection service |

AI fraud detection | |

|---|---|---|

| use information |

Purchaser input information Screen transition information |

Payment data held by us |

| at the time of introduction time |

Development for information acquisition For obtaining personal information Terms change |

nothing special *Business operator's own payment screen For use, a dedicated Install JavaScript on the payment screen |

| cost | Monthly cost Initial cost transaction cost |

Monthly cost |

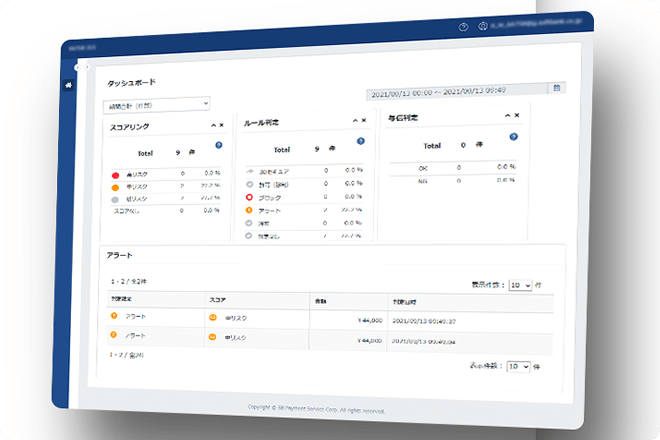

Understand your company's fraudulent usage trends

On the management screen, you can check various data such as credit card and browser information for each payment, so you can understand and analyze trends in fraudulent use occurring on your company's website and take countermeasures.

Items that can be checked on the management screen

- Score

- browser

- card brand

- browser language

- Card number (HASH value)

- browser IP address

- Card issuing country

and more

Reduce lost purchase opportunities

You can set your own rule judgment according to the fraudulent use trend of your company's website.

By automatically blocking mass purchases for the purpose of resale, the number of man-hours required for identity verification at the time of product shipment can be greatly reduced, and troubles such as those who want to purchase cannot buy, and the risk of reputational damage can be avoided.

*When using the Advanced Plan

further

Improved security

Is simply introducing an identity authentication service (EMV 3-D Secure) enough to prevent unauthorized use?

no. Even if you can avoid chargebacks with security measures such as EMV 3-D Secure, you may not be able to stop unauthorized use or damage from Credit Master attacks, or you may not be able to recover your products once they have been shipped.

AI fraud detection allows you to set unique rules according to the fraudulent usage trends of each website and rules specialized for countermeasures against Credit Master attacks, making it possible to further improve security.

*When using Standard Plan/Advanced Plan

*About Credit Master Attack here Please confirm

-

AI不正検知について

お問い合わせする AI不正検知について

お問い合わせする -

About AI fraud detection

Contact Us -

AI不正検知の資料を

ダウンロードする AI不正検知の資料を

ダウンロードする

Cooperate with various EC construction packages

*If you use Shopify, you can implement AI fraud detection by using the payment screen provided by our company.

Introduction example・

Seminar archive video

Offer plan

The lowest price in the industry! Monthly costs start from 0 yen, initial costs and

There are no transaction fees.

| I want to take easy measures | credit master I want to take measures against attacks. |

I want to block fraud using my own measures. | |

|---|---|---|---|

| plan | Free Plan | Standard Plan | Advanced Plan |

| Monthly cost | 0円 | 10,000円 | 100,000円 |

| Initial fee | 0円 | 0円 | 0円 |

| transaction cost |

0円 | 0円 | 0円 |

| Management screen | |||

| Incorrect Score Return | |||

| Confirmation of purchaser information | |||

| Configuring rule judgment | Default rules set by us (Credit Master Attack (Values can be changed) of Available |

Can be set independently by the operator | |

| EMV 3-D security of a Additional certification |

|||

| For those who recommendation |

|

|

|

* Separate application is required to use the additional authentication of EMV 3-D Secure.

* Credit Master Attack is a method of verifying the validity of credit card numbers automatically generated by a program or software by abusing the payment page of an e-commerce site. Please check here for more details

-

AI不正検知について

お問い合わせする AI不正検知について

お問い合わせする -

About AI fraud detection

Contact Us -

AI不正検知の資料を

ダウンロードする AI不正検知の資料を

ダウンロードする

Introduction speed

our online paymentfor the first timeBusinesses introducing

About 1 to 1.5 months

usingour online paymentBusinesses

Minimum 5 business days *

* If you use the payment screen provided by our company (version after March 9, 2020), you do not need to build a system and can start using it immediately.

When using the payment screen prepared by the business operator, it can be used by incorporating dedicated JavaScript into the payment screen.

* AI fraud detection is an optional service for our credit card payment.

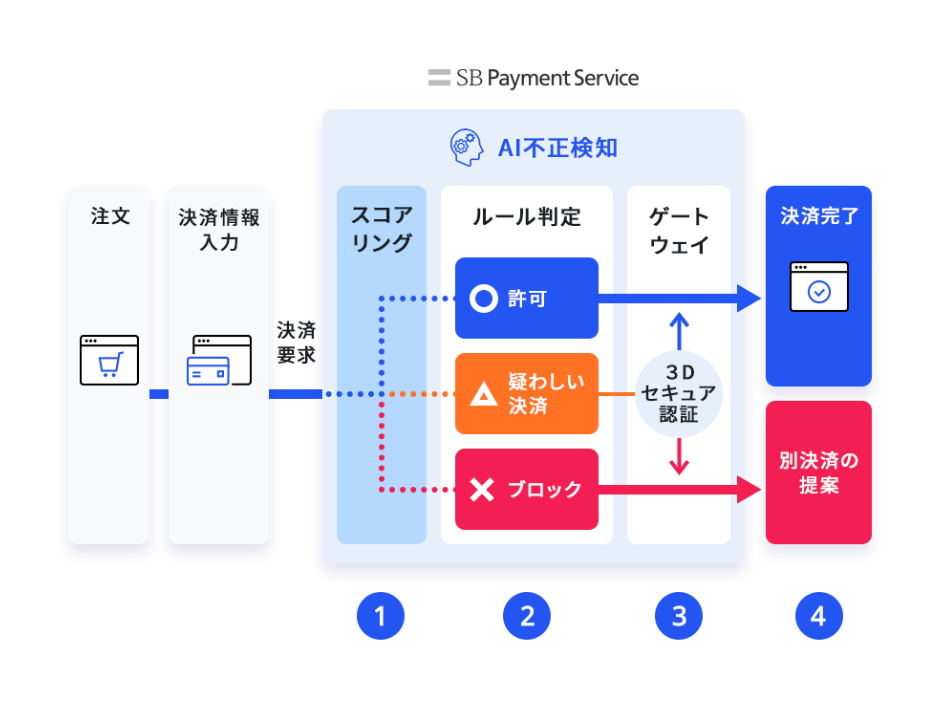

Flow of AI fraud detection

- When the user enters their credit card information,

Real-time fraud risk scoring - If you have configured rule judgment,

Determine if the set rule is met - If you have configured additional authentication,

Enforce EMV 3-D Secure authentication only for suspicious transactions - Payment will be completed once everything is approved

(If not approved, suggest another payment method)

* AI fraud detection can be used when paying by credit card

* Businesses can check the fraud risk score from the management screen and make decisions on product shipments, or check purchaser information to understand and analyze trends in fraudulent use of their websites. is

Rule judgment, tuning

No website expertise is required to configure rule judgments. You can easily set up by combining the items prepared by our company from the management screen. Settings can be changed (tuning) at any time according to the status of unauthorized use.

Items that can be set

- Score

- browser language

- commodity price

- browser IP address

- card brand

- Card number (HASH value)

- Card issuing country

- Number of past transactions with the same card

and more

決済導入をご検討の方は

お気軽にお問い合わせください

Please contact us to download detailed information about our services and to discuss costs and implementation.