PayPay (Online Payment)

Over 69 million users *1

You can introduce PayPay (Online Payment) easily and safely.

*1: As of May 2025

*The video is for illustrative purposes only.

What is PayPay (Online Payment)?

PayPay is a smartphone payment service provided by PayPay Corporation a joint venture between SoftBank Group Corp., SoftBank Corp., and Yahoo Japan Corporation Since launching its service in October 2018, the total number of registered users has exceeded 69 million (※1), and the number of affiliated stores has exceeded 4.1 million (※2).

PayPay (Online Payment) allows you to easily shop with your PayPay account. When making a payment, you can choose to pay using your PayPay balance, which can be charged using methods specified by PayPay Corporation such as bank accounts or SoftBank Mobile Wallet, and it is expected to attract users who do not have credit cards. In addition, since affiliated stores do not need to obtain personal information, you can make payments safely and securely.

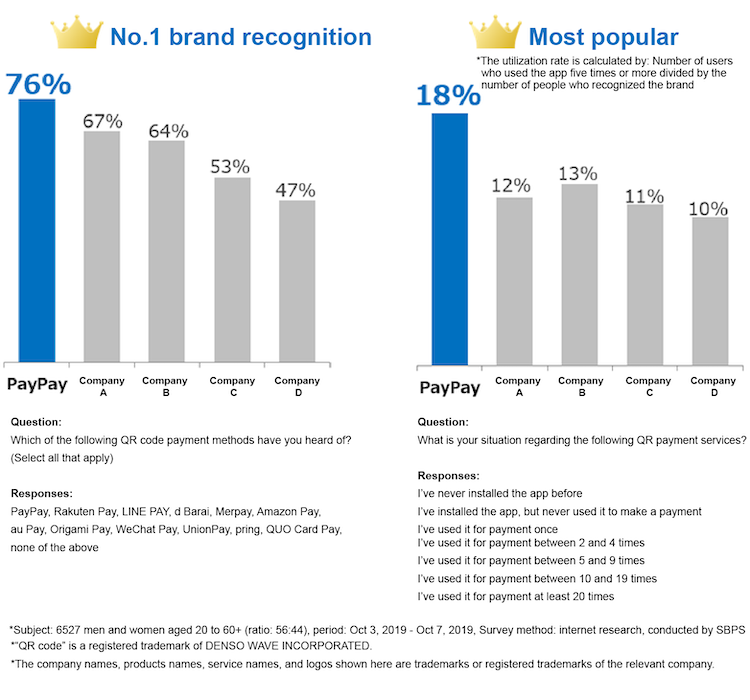

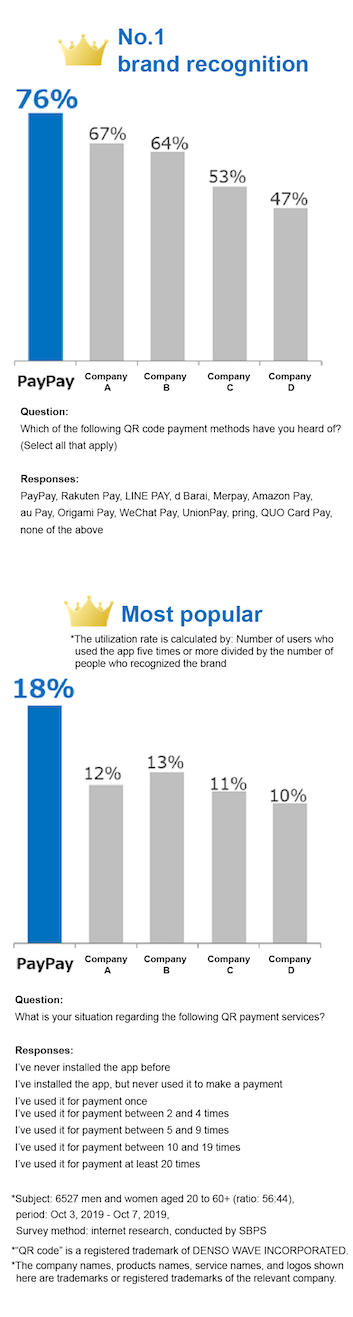

PayPay has the highest awareness among QR code payment methods, and the percentage of people who use it regularly is also high (see the figure below). Therefore, it is expected that these PayPay users will prefer to shop at EC sites that have adopted PayPay (Online Payment), which will also lead to an increase in customer numbers.

*1: As of May 2025

*2: As of March 2023

PayPay features

Increased userbase by utilizing Yahoo! and SoftBank’s membership assets

PayPay Corporation is increasing the number of PayPay users by leveraging its relationship with the 50 million SoftBank subscribers and Yahoo! members.

Increased ability to attract customers by providing special campaigns to users

Consolidating campaign measures for an unmatched scale of users together with the user campaigns of Yahoo! and SoftBank makes it possible to attract more customers to PayPay merchant stores.

Reduce annoying inputs and prevent cart abandonment

Since users can shop easily with their PayPay accounts, it reduces the time and effort required to enter information and prevent customers from abandoning their carts. As a result, your business can expect an increase in sales.

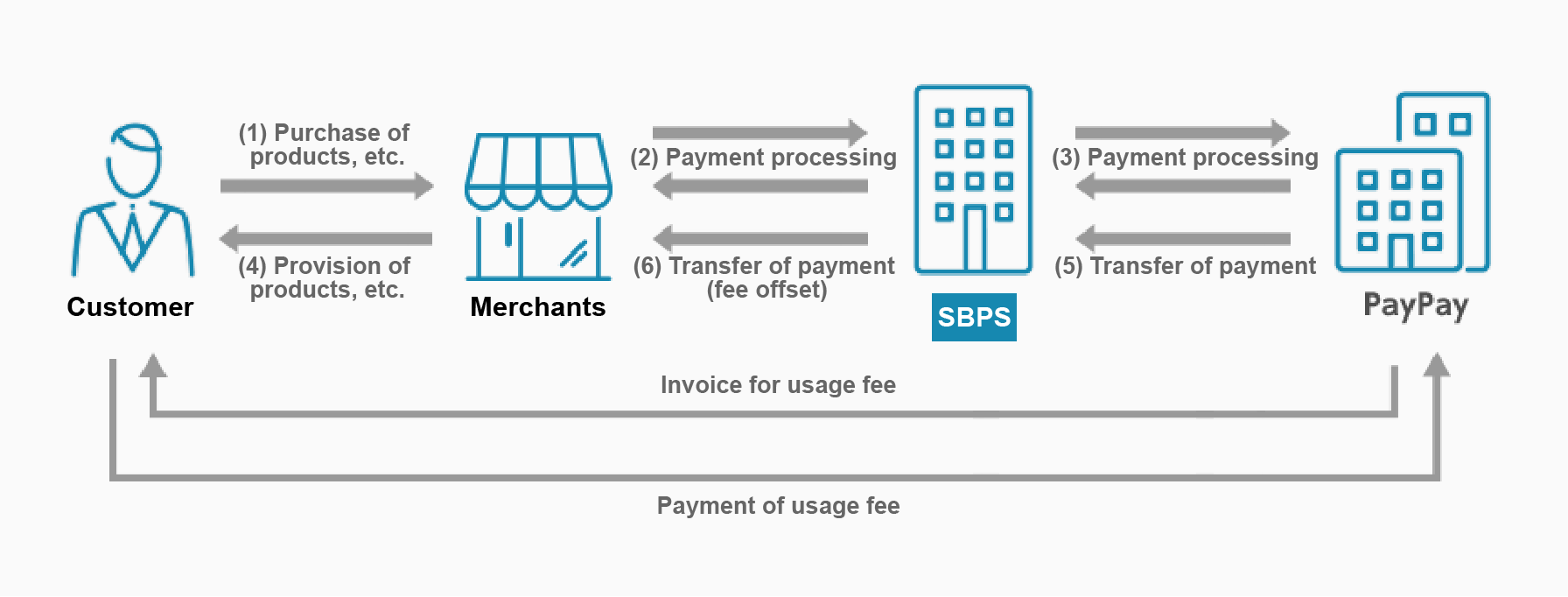

Flow from purchase to deposit with PayPay

Customers can use their PayPay balance to make payments on your e-commerce site simply by selecting PayPay as their payment method and logging in. There is no need to bother entering any information, preventing cart abandonment.

Functions provided with PayPay

| Connection methods | |

|---|---|

| Link type | API type |

| ○ | - |

| Billing methods | ||

|---|---|---|

| Pay-as-you-go | Recurring (simple) | Recurring (fixed / metered) |

| ○ | - | ○ |

| Settlement methods | |

|---|---|

| Automatic | Specified |

| ○ | ○ |

| Available websites | ||

|---|---|---|

| PC | Smartphone | Mobile phone |

| ○ | ○ | - |

| Connection methods | Link type | ○ | API type | - | |

|---|---|---|---|---|---|

| Billing methods | Pay-as-you-go | ○ | Recurring (simple) | - | Recurring (fixed / metered) | ○ | ||

|---|---|---|---|---|---|---|---|---|

| Settlement methods | Automatic | ○ | Specified | ○ | |

|---|---|---|---|---|---|

| Available websites | PC | ○ | Smartphone | ○ | Mobile phone | - | ||

|---|---|---|---|---|---|---|---|---|

PayPay payable amounts

| Payment method | Last 24 hours | Last 30 days |

|---|---|---|

| PayPay balance | 500,000 yen | 2 million yen |

| Payment method | PayPay balance | Last 24 hours | 500,000 yen | Last 30 days | 2 million yen |

|---|

- Information as of January 31, 2020

- The lower limit is 1 yen, and the upper limit is as above.

Implementation method

The procedures from application to getting started are as follow.

For details on implementation procedures and costs, please see Implementation and fees

-

merchants inquiries

-

SBPS interviews and estimates

-

merchants Application

-

Our (SBPS) review

-

Our company (SBPS) system construction

-

merchants connect to the system/start using it

We will also provide you with a quote regarding usage fees (fees, etc.) after we ask for details, so please contact us using the inquiry button below.

If you are considering introducing payment

Please feel free to contact us

Please contact us to download detailed information about our services and to discuss costs and implementation.

Delivered by SB Payment Service

Recommended Content

-

PayPay (online payments) usage examples

Here we explain the PayPay (Online Payment) payment process with easy-to-understand screenshots.

-

RakutenPay (Online)

A payment service for customers with a Rakuten ID.

-

Recruit Kantan payment

A payment service for customers with a Recruit ID.

-

Wallet Payment Service (Type-Y)

A payment service for customers with a Yahoo! JAPAN ID.